Market assessment

Major recovery on advertising market

The economy recovered well during 2021. In the third quarter of 2021, Swiss economic performance exceeded the pre-crisis level of 2019 by 1 per cent. The positive trend for the wider economy translated into an upswing on the employment market. For example, the seasonally adjusted average unemployment rate for Switzerland fell from 3.3 per cent in 2020 to 2.4 per cent in 2021.

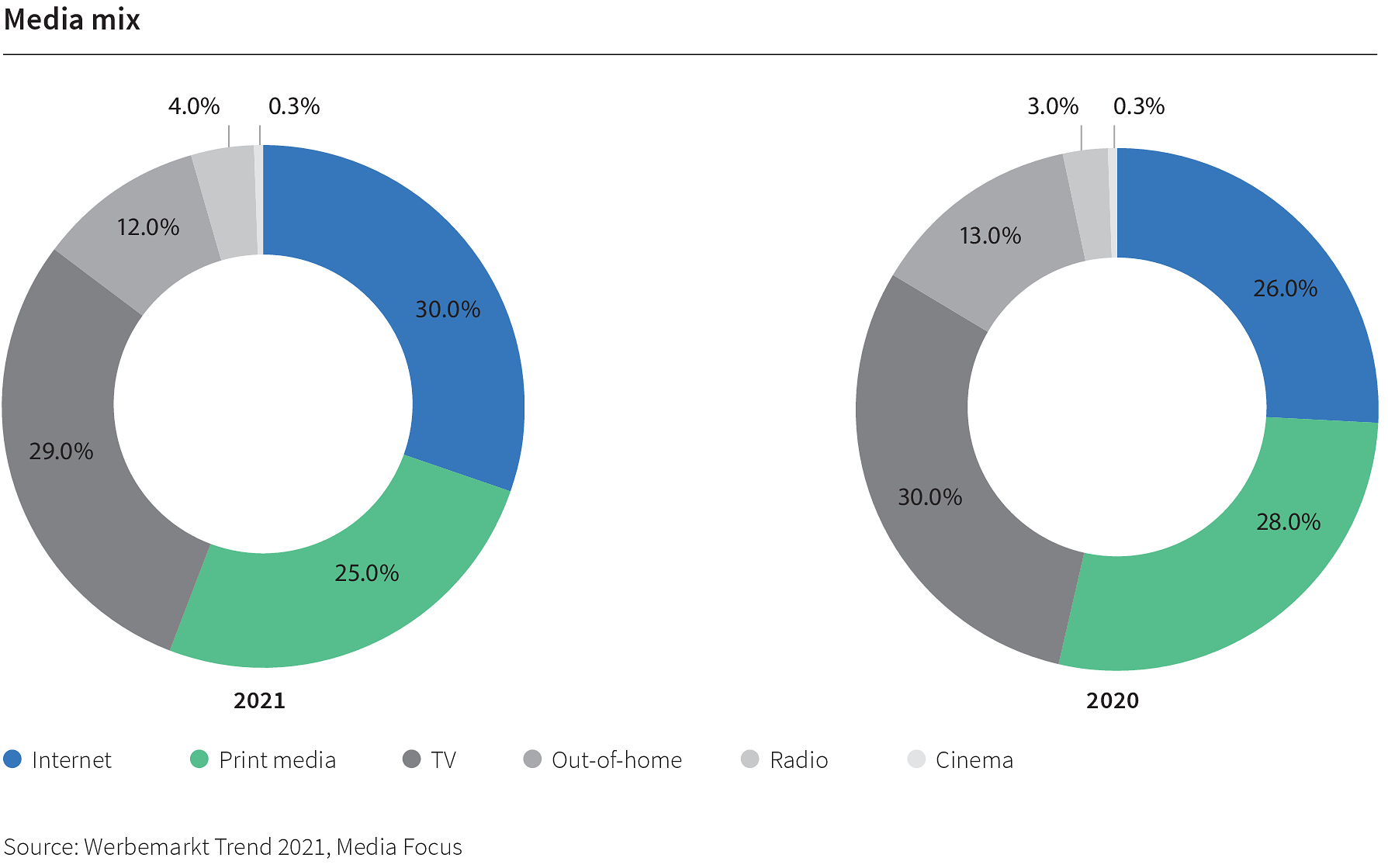

After the early part of the reporting year had been affected by heavy restrictions imposed due to the coronavirus pandemic, the successive easing of measures heralded a recovery on the advertising market. According to Media Focus, advertising expenditure in 2021 increased by 12.3 per cent or CHF 613 million compared with the previous year to CHF 5.6 billion. The biggest increases were achieved online (CHF +410 million) and by television (CHF +116 million). Advertising expenditure was still significantly below the previous year in the first quarter and grew continuously over the course of the year. 20 out of 21 sectors invested more in advertising in 2021 than they did the year before. The biggest increase was recorded by retail (CHF 54.9 million) and the finance sector (CHF 33.5 million). Events too saw a significant increase in advertising expenditure year on year (CHF 26.7 million). The global digital players again increased their slice of the Swiss advertising cake in 2021.

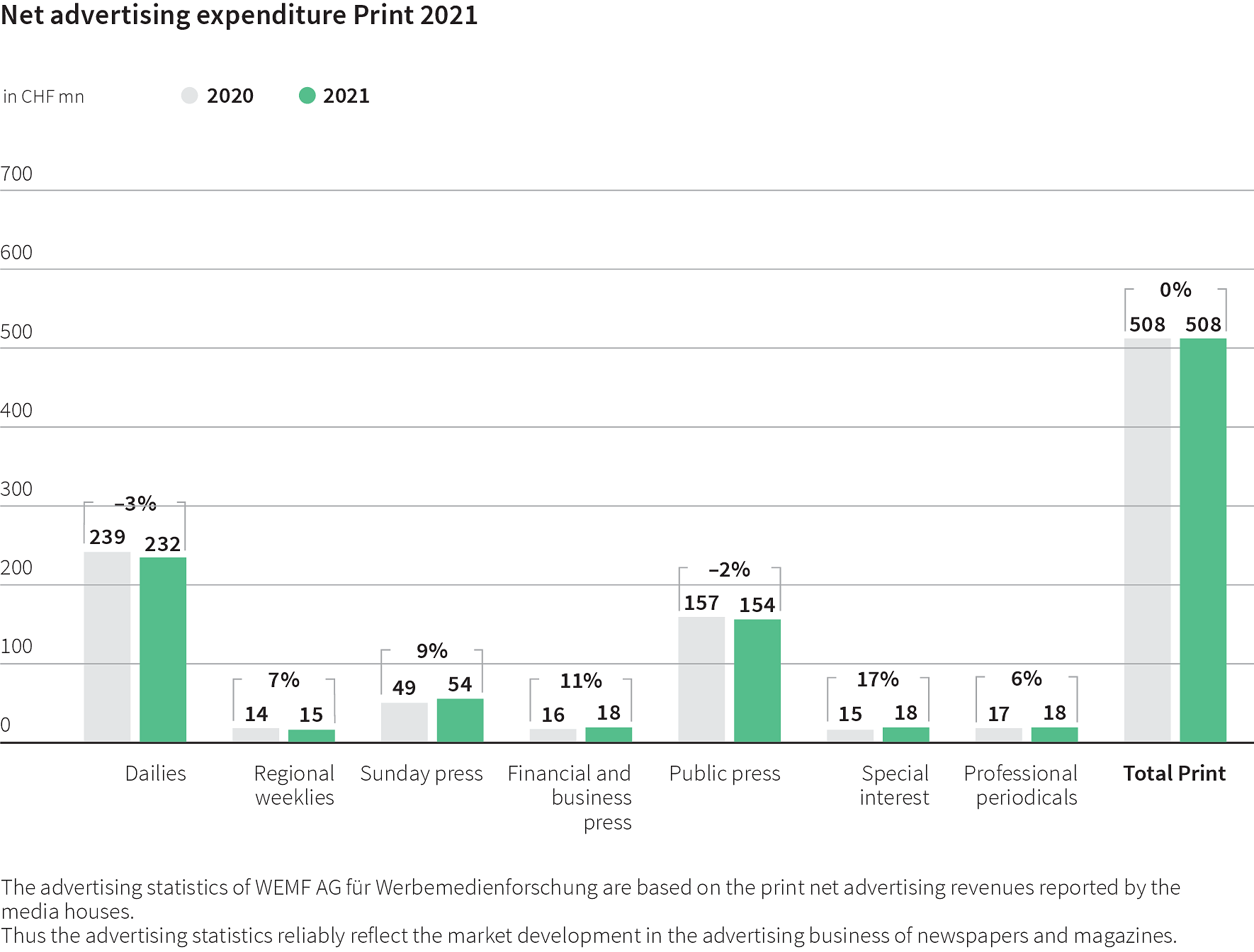

Print advertising stable

The advertising market for the printed press remained stable year on year in 2021, with individual sections experiencing different fortunes. For example, the specialist press, the financial and business press and the Sunday newspapers in particular all saw their income increase. This positive trend extended to the regional weekly press, the daily press II/III segment (circulation of less than 40,000) and professional periodicals. Only the daily press I segment, i.e. with a circulation of more than 40,000 copies, and the popular press secured less advertising revenue than the previous year. With the employment market picking up, print advertising for jobs also improved by just over 9 per cent according to advertising statistics from WEMF. And according to the Adecco Swiss Job Market Index, which takes account of digital job advertisements too, the Index has not seen such rapid growth in recruitment since measurements began in 2003. In the fourth quarter of 2021, there were 39 per cent more job advertisements compared with the previous year.

The Federal Expert Group on Business Cycles is predicting that gross domestic product (GDP), adjusted to exclude sporting events, will grow at an above-average rate of 3.3 per cent in 2022. This assumes the situation will stabilise once more from an epidemiological perspective and that the issues affecting global capacity levels will not persist for longer than anticipated. Both exports and domestic demand are expected to provide the impetus for better-than-average growth in GDP – at least temporarily. The TX Group assumes that TV, print and radio advertising will see volumes remain stable for the current year. Higher revenue levels are expected for digital advertising and, as mobility improves from spring onwards, for out-of-home advertising too.