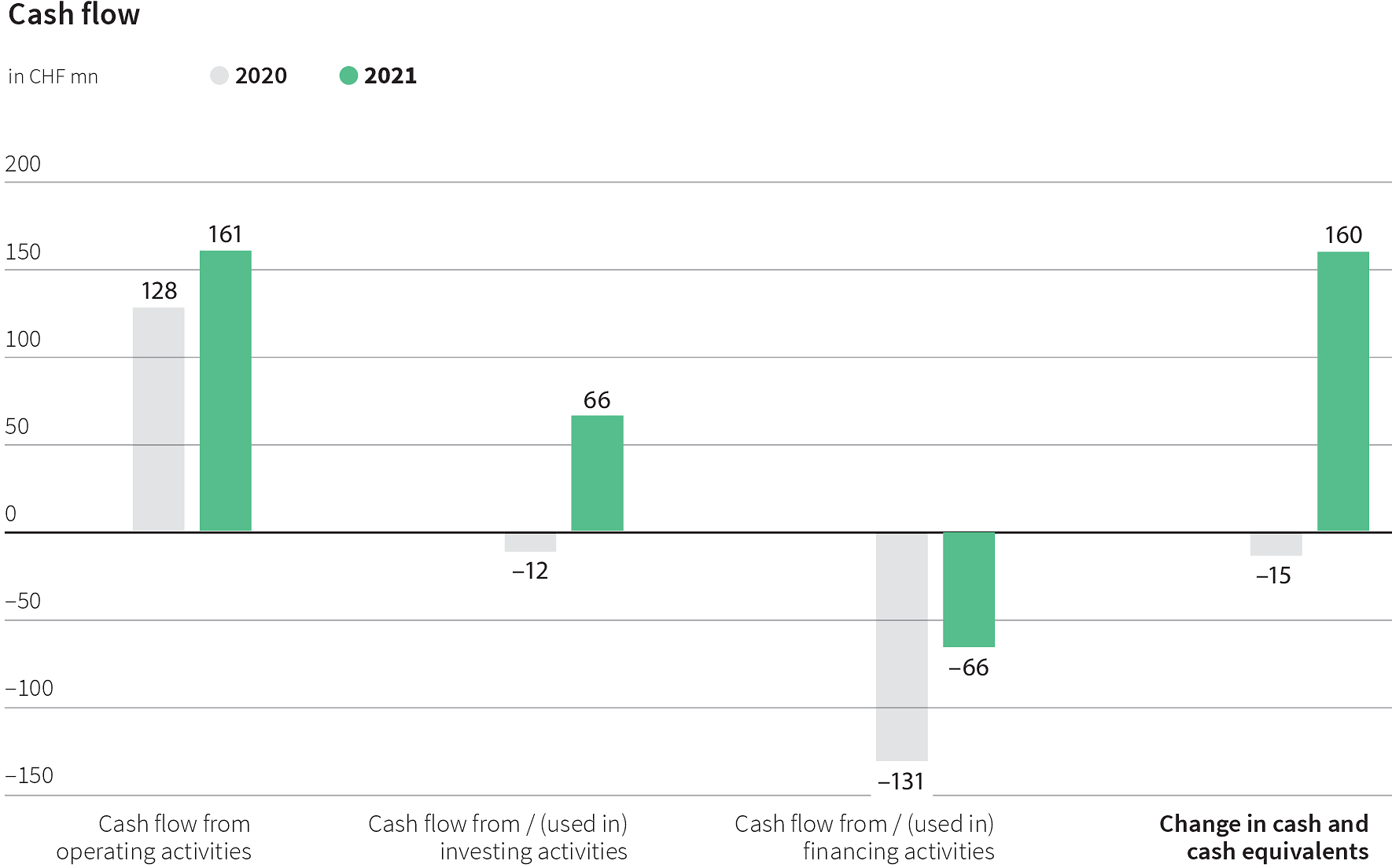

Statement of cash flows

Cash flow from (used in) trading activities increased by CHF 32.2 million from the previous year to CHF 160.3 million. The increase is attributable in particular to improved net income (EAT), with the previous year characterised by significant revenue reductions associated with the coronavirus crisis. An incoming payment of CHF 11.8 million was also recorded as a result of legal proceedings and is recognised as liquid assets under other financial income.

Cash flow from (used in) investing activities amounted to CHF 65.8 million (previous year: CHF -11.8 million). The incoming funds, as compared with the previous year, are attributable in particular to the sale of 10 per cent of TX Markets shares to General Atlantic SC B.V., as half the sale price was paid in cash (CHF 135 million). Together with the sale of GOWAGO and BTMX, this resulted in total incoming funds of CHF 145.5 million, which is disclosed as disposals of investments in associates. There were net cash outflows of CHF 8.9 million from the purchase of the newly consolidated company Helvetics Engineering d.o.o., which has now merged with TX Services d.o.o., the increased stake in neon Switzerland AG and the purchase of Acheter-Louer.ch & Publimmo Sàrl. With the transferred companies being integrated into the new SMG Swiss Marketplace Group AG joint venture, this has resulted in further cash outflows of CHF 12.4 million. Cash outflow from investments in other financial assets includes the investment in bond funds in the amount of CHF 20 million, which was prompted by ongoing negative interest rates. Bond funds are highly liquid and have a fairly short-term investment horizon. Other effects resulted from changes to current accounts with non-controlling interests and increases in loans involving associates. Sales of other financial assets cover, among other things, repayment of the loan from the sale of Olmero AG in the amount of CHF 12.2 million. As a result of investments in property, plant and equipment made in 2021, there were further cash outflows of CHF 16.9 million, such as those associated with conversion work at the Werdstrasse and Küsnacht sites or investments in IT hardware for out-of-home advertising. CHF 14.0 million was invested in intangible assets, in particular for the capitalisation of software projects at JobCloud AG and other investments in the area of webshops and paywalls. The sale of property, plant and equipment and intangible assets resulted in a cash inflow in the amount of CHF 0.4 million. Cash flow after investing activities in property, plant and equipment and intangible assets (FCF b. M&A) amounts to CHF 129.9 million, which significantly exceeds the previous year’s figure of CHF 94.5 million.

Cash flow from (used in) financing activities amounts to CHF -65.0 million (previous year: CHF -131.4 million). The significantly lower cash outflows compared with the previous year are attributable in particular to the decision not to pay a dividend to TX Group shareholders for the 2020 financial year, with dividend payments to the non-controlling interests of JobCloud AG and the Goldbach Group also down by around CHF 10.9 million on the previous year. In 2020, the purchase of non-controlling interests in Homegate AG resulted in a cash outflow of CHF 20.8 million, while in the current year the purchase of non-controlling interests in Zattoo AG saw an outflow of CHF 9.6 million. Repayments associated with current accounts or loans only amounted to CHF 2.0 million in the current year, compared with a cash outflow of around CHF 20.6 million in the previous year. Rental payments increased by CHF 1.9 million to CHF 17.3 million as a result of new or modified leases.

The various flows led to an increase in cash and cash equivalents of CHF 160.3 million in 2021, from CHF 276.2 million to CHF 436.5 million.