Balance sheet and equity

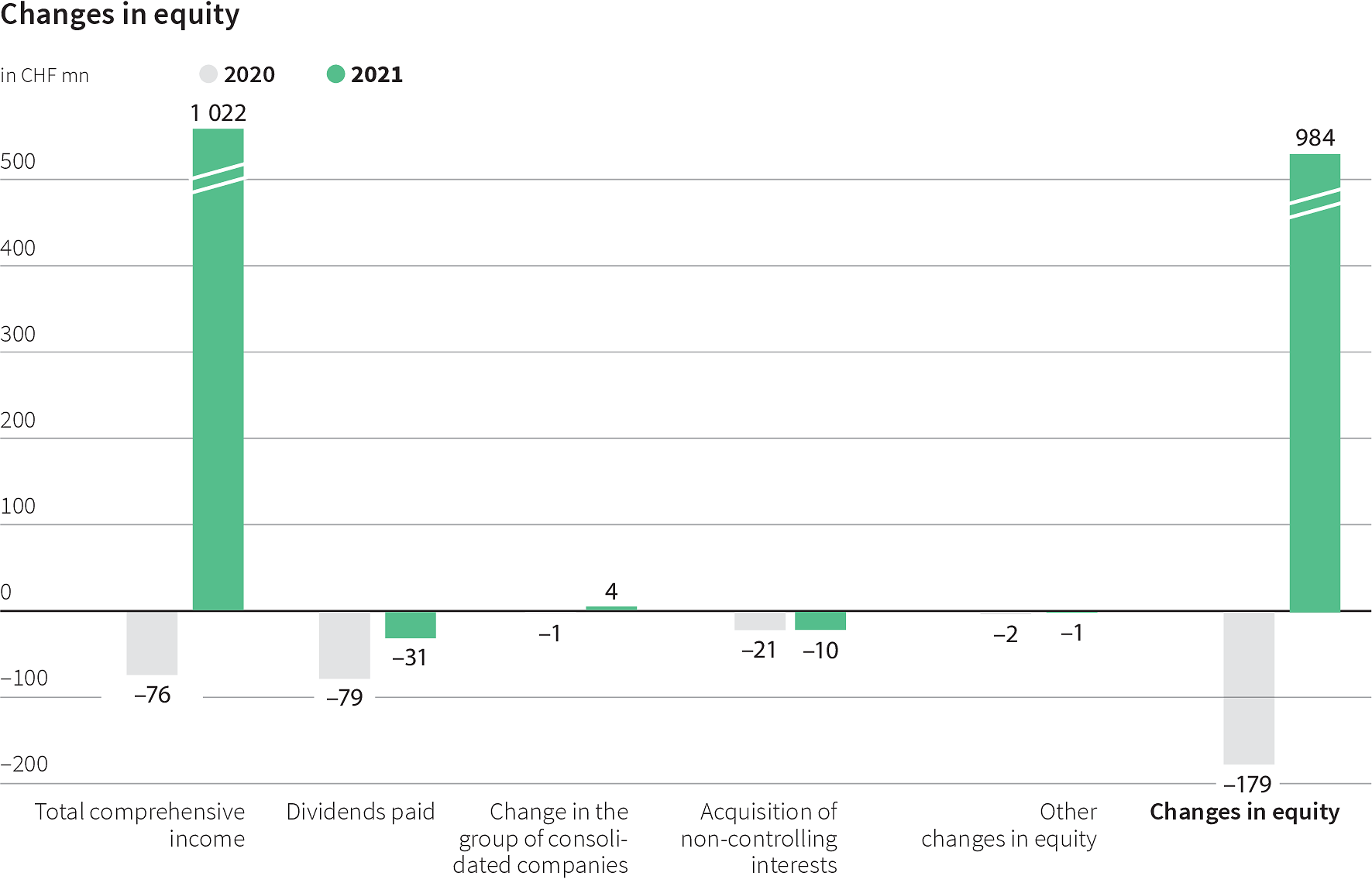

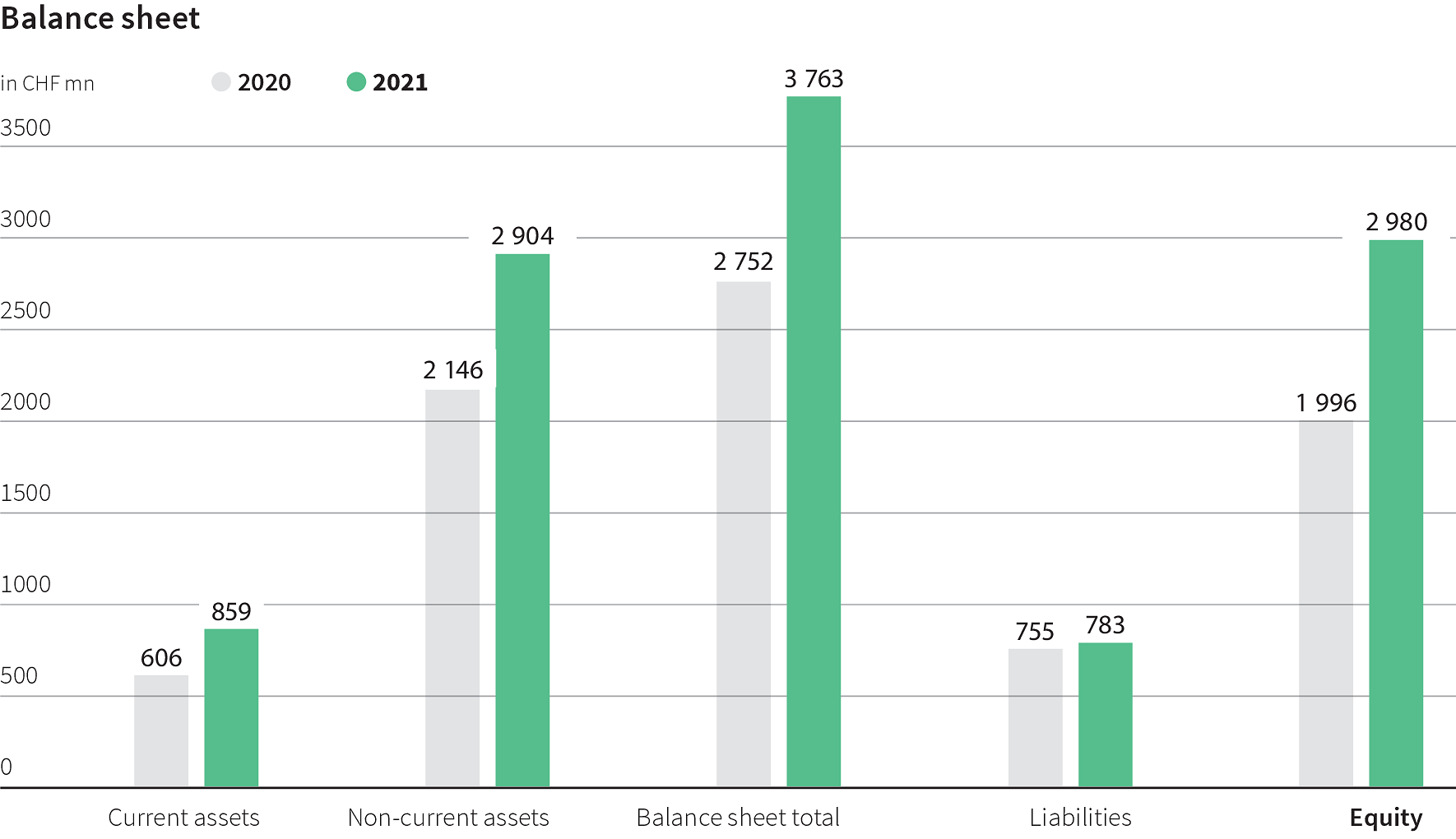

Total assets increased by CHF 1,011.8 million, from CHF 2,751.6 million to CHF 3,763.4 million. Equity increased by CHF 983.7 million to CHF 2,980.1 million. The increase in equity is due in particular to the net income (EAT) of CHF 832.7 million achieved and the amount, recognised directly as equity, for the revaluation of employee benefits by a net CHF 193.0 million (after deferred taxes) resulting from the performance of employee benefit plan assets and actuarial gains associated with employee benefit obligations. The company’s equity ratio increased from 72.6 per cent to 79.2 per cent.

Current assets increased by CHF 252.9 million to 859.0 million. Contributions to this included the increase in cash and cash equivalents by CHF 160.3 million to CHF 436.5 million, investments in current financial assets (bond funds) in the amount of CHF 20.0 million and the recognition of current financial receivables associated with the contractually agreed special dividend from SMG Swiss Marketplace Group AG to TX Group AG (CHF 89.8 million).

Non-current assets rose by CHF 758.9 million or 35.4 per cent to CHF 2,904.4 million. Property, plant and equipment reduced by CHF 21.2 million during the reporting year and amount to CHF 302.1 million as of the balance sheet date. Intangible assets decreased by CHF 421.1 million from CHF 1,578.8 million to CHF 1,157.7 million. Due to the disposal of TX Markets companies, intangible assets declined by CHF 370.2 million.

The share of equity accounted for by associates and joint ventures amounts to CHF 900.5 million, which equates to an increase of CHF 839.5 million (previous year: CHF 61.2 million). The shares in SMG Swiss Marketplace Group AG were recognised at CHF 837.0 million as of 1 November 2021 and have since been updated via equity accounting (see Note 1 “Changes to the group of consolidated companies”). The revaluation of employee benefit plans means that net plan assets of CHF 320.6 million are included in the balance sheet for 2021 (previous year: CHF 94.9 million). Employee benefit assets and liabilities totalled CHF 348.1 million and CHF 27.5 million respectively. Other non-current financial assets increased by CHF 157.5 million to CHF 193.5 million. The increase is attributable in particular to the interest-bearing loans issued by TX Group AG to General Atlantic SC B.V. in the amount of CHF 137.4 million (incl. accrued interest) and SMG Swiss Marketplace Group AG in the amount of CHF 15.2 million. . In the reporting year, investments were also made in relation to both new (such as PriceHubble AG, Backbone Art SA or Helvengo AG) and existing other interests (such as Switzerlend AG and neon Switzerland AG). The investments in neon Switzerland AG increased the TX Group AG share to 21.7 per cent, with this now being recorded as an associated company.

Current liabilities decreased by CHF 6.0 million to CHF 474.7 million. Current and non-current financial liabilities increased by CHF 40.4 million to CHF 133.6 million. Non-current loan liabilities increased because of the loan, which still existed as of the balance sheet date, by SMG Swiss Marketplace Group AG to TX Group AG in the amount of CHF 64.2 million. By contrast, the deconsolidation of TX Markets companies means the loan by shareholders to Car For You AG is no longer reported.

Other current liabilities amount to CHF 31.2 million and are therefore down by around CHF 22.2 million on the previous year. The reduction can be explained in terms of the situation on the balance sheet date, particularly with liabilities to public authorities being CHF 7.3 million lower on the reporting date compared with 31 December 2020. Changes to the group of consolidated companies also accounted for CHF 6.2 million of the reduction.

Deferred revenues and accrued liabilities (total for deferred revenues and accrued liabilities from contracts with customers and other deferred revenues and accrued liabilities) increased by CHF 10.7 million from CHF 328.9 million to CHF 339.6 million. Changes to the group of consolidated companies result in a decrease of around CHF 6.0 million. Total deferred revenue declined by CHF 9.4 million. By contrast, accruals relating to personnel increased by CHF 8.9 million to CHF 32.2 million, mainly due to the higher accruals for employee performance bonuses.

Current and non-current provisions remained stable compared with the previous year (CHF 15.6 million) at CHF 14.8 million.

Non-current liabilities increased by CHF 34.1 million to CHF 308.6 million. Employee benefit obligations dropped by CHF 15.4 million to CHF 27.5 million. Deferred tax liabilities rose by CHF 10.9 million to CHF 156.1 million.