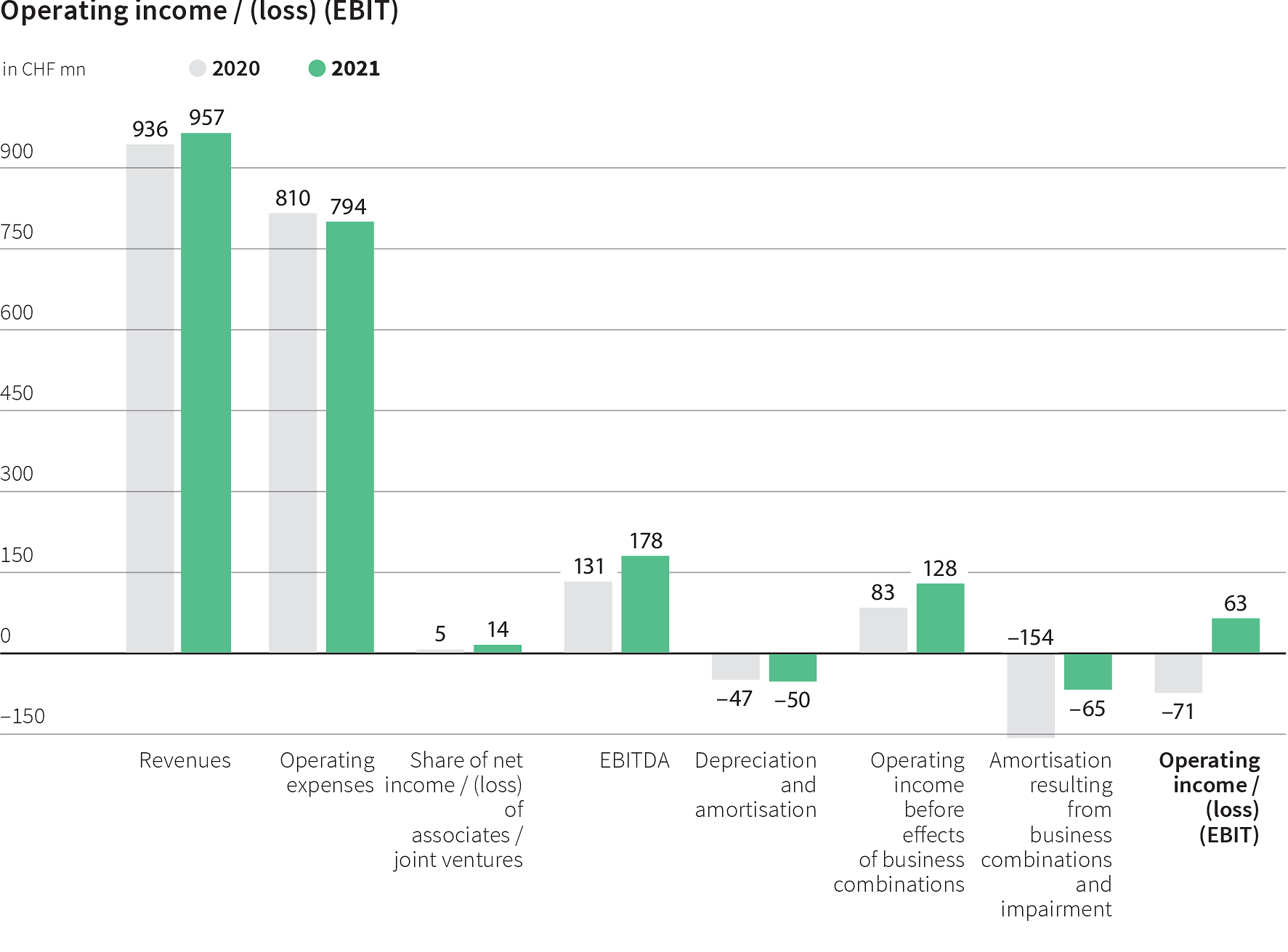

Operating income before depreciation and amortisation (EBITDA), operating income before effects of business combinations (EBIT b. PPA) and operating income (EBIT)

Operating income before depreciation and amortisation (EBITDA) increased by CHF 47.0 million or 36.0 per cent to CHF 177.7 million. The EBITDA margin increased therefore from 14.0 per cent in the previous year to 18.6 per cent.

The share of net income of associates and joint ventures for the reporting year of 2021 is CHF 14.3 million (previous year: CHF 4.8 million). The increase is attributable to increased operating income. The associated company Karriere.at accounted for much of this.

Operating income before the effects of business combinations (EBIT b. PPA) is up 53.5 per cent or CHF 44.6 million to CHF 127.9 million (previous year: CHF 83.3 million). The margin amounts to 13.4 per cent (previous year: 8.9 per cent).

Operating income (EBIT) amounts to CHF 63.3 million (previous year: CHF -70.9 million), which results in an EBIT margin of 6.6 per cent, as compared to -7.6 per cent in the previous year.

Overall depreciation and amortisation (total covering depreciation and amortisation proper and that resulting from business combinations) reduced compared with the previous year by CHF 2.1 million to CHF 114.4 million. Based on a goodwill impairment test, no requirement for any impairment on goodwill was identified in 2021. In the previous year, an impairment on goodwill of CHF 85.0 million was recorded for the cash-generating unit Tamedia.