Goldbach

www.goldbach.com

Managing Director: Michi Frank

| in CHF mn | 2023 | 2022 | Change | |||

|---|---|---|---|---|---|---|

| Advertising revenue 1 | 122.3 | 46.8 | 161.3% | |||

| Classifieds & services revenue 1 | 11.5 | 10.6 | 8.1% | |||

| Commercialization revenue 1 | 125.2 | 124.5 | 0.5% | |||

| Other operating revenue 1 | 15.6 | 9.1 | 70.3% | |||

| Other income 1 | 0.2 | 0.5 | –55.6% | |||

| Revenues | 274.7 | 191.5 | 43.4% | |||

| of which organic revenues 2 | 202.1 | 191.5 | 5.5% | |||

| Operating expenses 3 | (193.3) | (141.5) | 36.6% | |||

| Share of net result of associates / joint ventures | (0.0) | 0.0 | n.a. | |||

| Operating income / (loss) before depreciation and amortisation (EBITDA) | 81.4 | 50.1 | 62.6% | |||

| Margin 4 | 29.6% | 26.1% | 3.5%p | |||

| Depreciation and amortisation | (57.3) | (28.9) | 98.0% | |||

| Operating income / (loss) before effects of business combinations (EBIT b. PPA) | 24.1 | 21.2 | 14.2% | |||

| Margin 4 | 8.8% | 11.0% | –2.3%p | |||

| Depreciation and amortisation resulting from business combinations | (18.2) | (13.8) | 32.0% | |||

| Operating income / (loss) (EBIT) | 5.9 | 7.4 | –19.3% | |||

| Margin 4 | 2.2% | 3.8% | –1.7%p | |||

| Normalisation 5 | 18.9 | 13.8 | 36.5% | |||

| Operating income / (loss) (EBIT adj.) | 24.8 | 21.2 | 17.1% | |||

| Margin 4 | 9.0% | 11.1% | –2%p | |||

| Number of employees (FTE) 6 | 838 | 674 | 24.3% | |||

|

|

||||||

|

1 Includes third-party revenue and revenue vis-à-vis other TX segments.

|

||||||

|

2 Includes only companies and activities that were included in the scope of consolidation for the entire reporting period 2023 and 2022. In the Goldbach segment, the contribution of Clear Channel Schweiz and AdUnit was excluded accordingly in the current period.

|

||||||

|

3 No IAS 19 pension costs (as in segment reporting).

|

||||||

|

4 The margin relates to revenue.

|

||||||

|

5 Normalisation effects:

– Correction of deferred revenue from initial consolidation of Clear Channel Schweiz (2023: CHF 0.6 million). – Amortisation resulting from business combinations (2023: CHF 18.2 million; 2022: CHF 13.8 million). |

||||||

|

6 Average number of employees, excluding employees in associates / joint ventures.

|

||||||

Goldbach markets and brokers advertising across the following areas: TV, radio, print, online, mobile, out-of-home advertising and performance marketing. The advertising inventories originate mainly from TV broadcasters (groups), radio stations, owners of outdoor advertising spaces or providers of sites for outdoor advertising spaces, websites (online publishers) and newspaper publishers. Goldbach has also been marketing the advertising inventories of 20 Minuten and Tamedia since 2020.

Like 2022, 2023 was a challenging year for Goldbach. The year also marked a milestone: the acquisition of Clear Channel Schweiz gave out-of-home advertising a real boost and laid the foundations for a highly promising future of profitable growth. Despite the one-off costs associated with the integration of Clear Channel Schweiz, the acquisition has already resulted in a clear increase in net income (EBITDA, EBIT adj.) for Goldbach in the reporting year. Revenues also increased significantly thanks to acquisitions.

In the marketing area, Goldbach is still facing declining revenues within the core business of TV and print. Some important success was achieved though securing new clients (TF 1, TRC and Swiss 1) as of 2024. With these new clients and thanks to strict cost management, Goldbach is also optimistic about the future in the area of commercialization.

By tapping into new revenue streams and with its strong position in the growth area of out-of-home advertising, the aim is to compensate for the decline in revenues in the core TV and print business in the medium term. These include, for example, the replay ads on TV introduced in 2022 and the strategic focus on regional sales and attracting SME customers. At the end of 2023, Goldbach Group agreed on a management buyout with the management of the digital agency dreifive. The sale of dreifive is to be seen as a logical step in Goldbach Group’s strategic focus on the marketing of advertising. The transaction is scheduled to be completed in the second quarter of 2024.

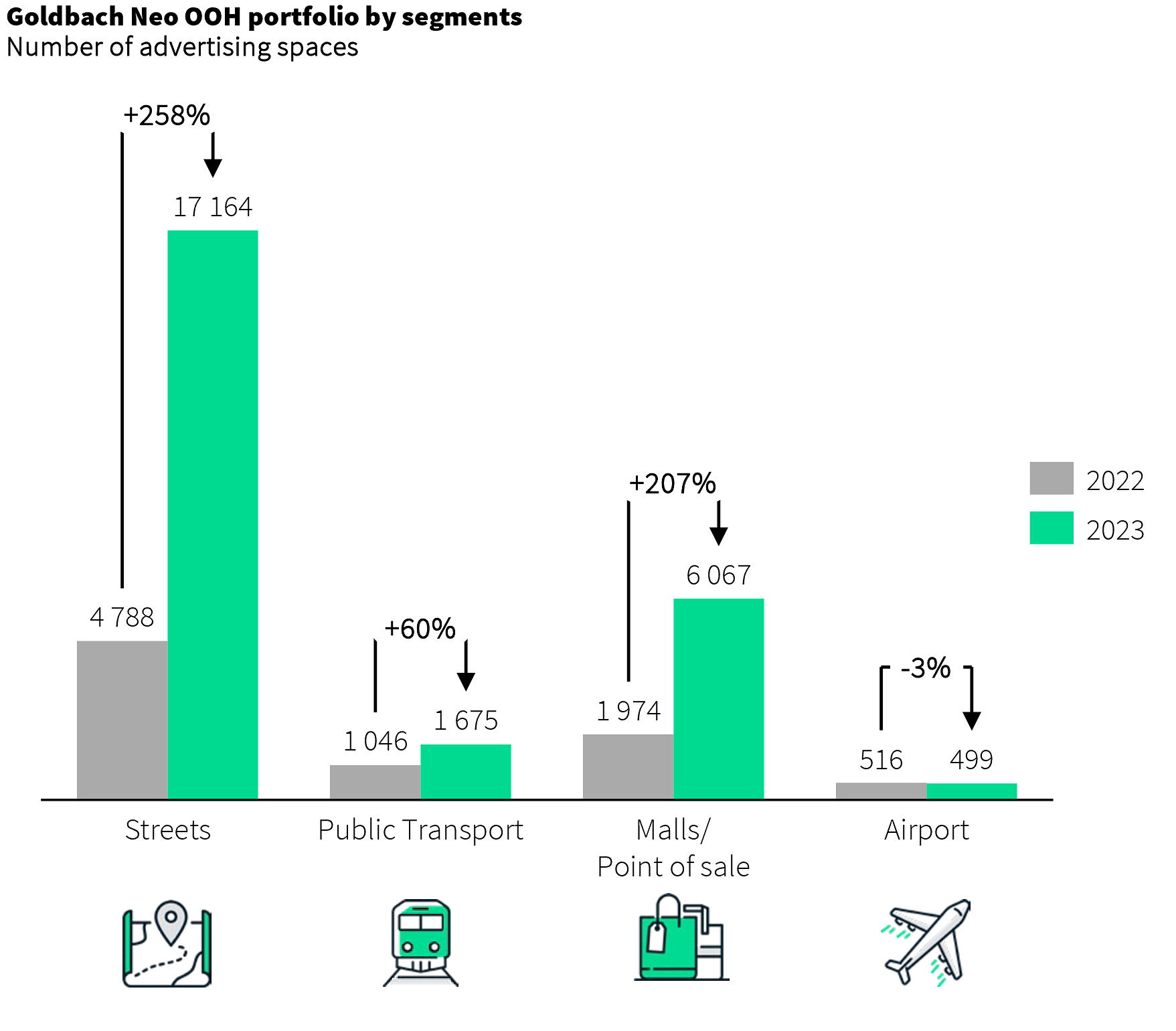

Out-of-home advertising: successful founding of Goldbach Neo OOH AG

Announced at the end of December 2022, the acquisition of Clear Channel Schweiz was completed in the reporting year. The closing was on 31 March 2023. The remaining non-controlling interests of Neo Advertising AG were duly acquired. As of 27 June 2023, Clear Channel Schweiz AG was renamed Goldbach Neo OOH AG. The integration of Neo Advertising AG into Goldbach Neo OOH AG took place at the end of September 2023. Since then, the entire out-of-home advertising inventory of the previous companies may be recognised for Goldbach Neo for 2024.

Focus on regional sales and attracting SME customers

Goldbach’s acquisition of the former Swisscom subsidiary AdUnit, at the start of the year, was part of the focus on attracting business among the SME customer group. Thanks to AdUnit’s established software solution, even customers with a small advertising budget can enjoy easy access to quality advertising media in Switzerland. Customers benefit from tech-supported services, a fully automated approach to campaign optimisation and evidence of performance in the form of live reporting. The Goldbach Regional area was founded in early 2024 and will take care of regional sales from now on. As early as the first seven months of the actual test phase in 2023, over 250 new customers were acquired, whose advertising campaigns were processed via the new Goldbach booking tool.