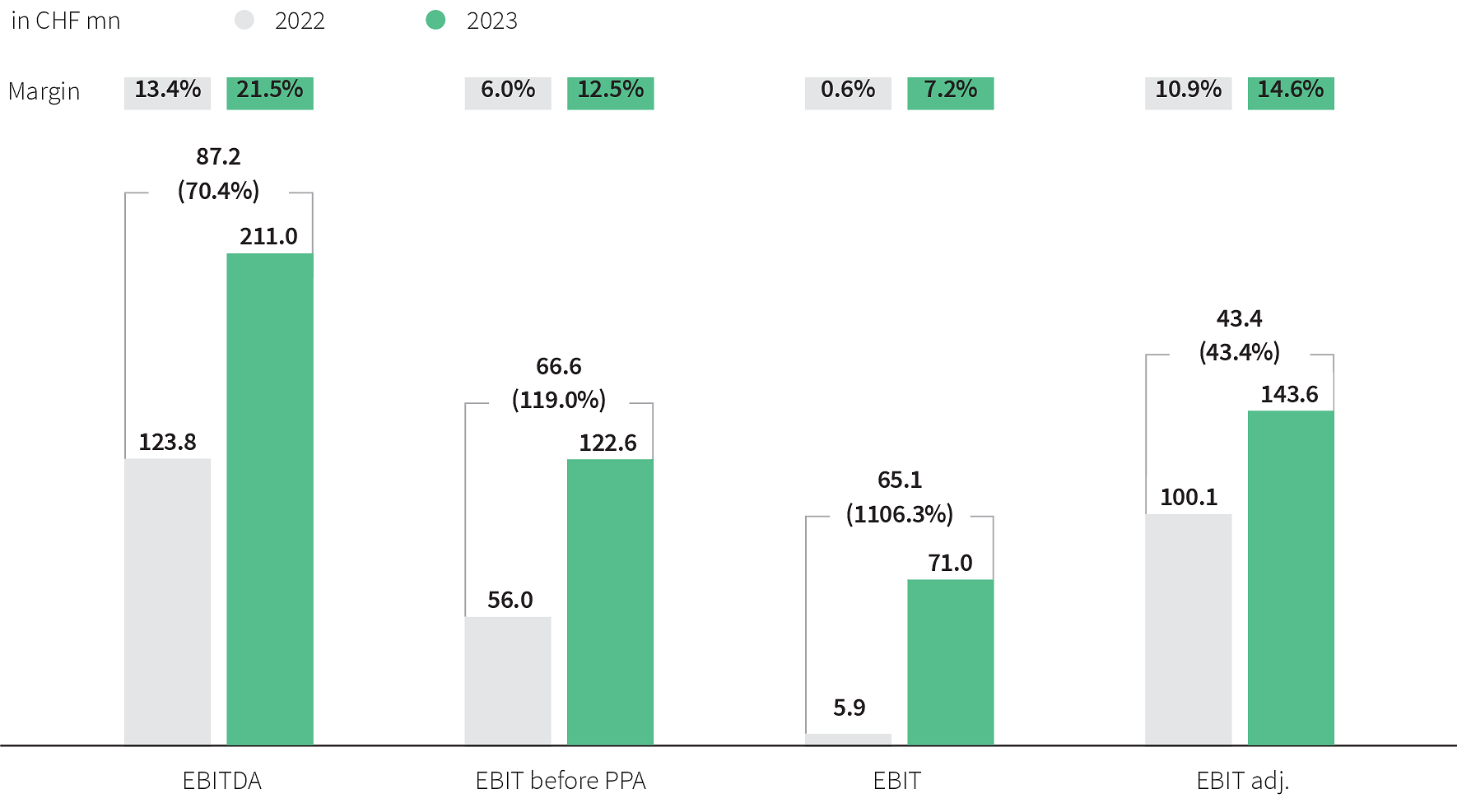

Net operating income / (loss) and margin

EBITDA, EBIT before PPA, EBIT and the margin were significantly up on the previous year. The reason for this was the positive performance of the SMG Swiss Marketplace Group investment and the significantly lower expense for pension provisions on account of the adjustment to the discount rate as of January 2023 (IAS 19). The optimisation of business processes at Tamedia and 20 Minuten and the associated cost reductions also had a positive effect on net income.

Normalised EBIT adj. amounts to CHF 143.6 million, which corresponds to an increase of 43.4 per cent on the previous year. The normalisation of depreciation and amortisation from business combinations represents the biggest impact at CHF 51.6 million (previous year: CHF 50.1 million). The reporting period also saw a normalisation in the amount of CHF 19.6 million (previous year: CHF 42.4 million) performed in relation to the share of net result of associates / joint ventures in connection with the proportionate depreciation and amortisation from business combinations at SMG Swiss Marketplace Group in the amount of CHF 14.8 million as well as impairments at other associated companies. Normalisations in 2023 also include correction of deferred revenue at Clear Channel Schweiz in the amount of CHF 0.6 million (Goldbach segment) and Berner Oberland Medien in the amount of CHF 0.8 million (Tamedia segment). With these, deferred revenues were adjusted to their fair value as part of the initial consolidation.

The normalised consolidated income statement contains further details on normalisations.