20 Minuten

www.20min.ch

Managing Director: Bernhard Brechbühl

| in CHF mn | 2023 | 2022 | Change | |||

|---|---|---|---|---|---|---|

| in CHF mnAdvertising revenue 1 | 2023107.4 | 2022105.7 | Change1.7% | |||

| in CHF mnClassifieds & services revenue 1 | 20234.3 | 20224.4 | Change–1.4% | |||

| in CHF mnOther operating revenue 1 | 20236.5 | 20224.8 | Change37.6% | |||

| in CHF mnOther income 1 | 20230.1 | 20220.2 | Change–42.8% | |||

| in CHF mnRevenues | 2023118.4 | 2022115.0 | Change3.0% | |||

| in CHF mnof which organic revenues 2 | 2023118.4 | 2022115.0 | Change3.0% | |||

| in CHF mnOperating expenses 3 | 2023(105.8) | 2022(101.2) | Change4.5% | |||

| in CHF mnShare of net result of associates / joint ventures | 2023(2.5) | 2022(5.5) | Change–53.6% | |||

| in CHF mnOperating income / (loss) before depreciation and amortisation (EBITDA) | 2023 10.1 | 2022 8.3 | Change 21.5% | |||

| in CHF mnMargin 4 | 20238.5% | 20227.2% | Change1.3%p | |||

| in CHF mnDepreciation and amortisation | 2023(1.0) | 2022(0.9) | Change11.9% | |||

| in CHF mnOperating income / (loss) before effects of business combinations (EBIT b. PPA) | 2023 9.1 | 2022 7.4 | Change 22.6% | |||

| in CHF mnMargin 4 | 20237.7% | 20226.5% | Change1.2%p | |||

| in CHF mnDepreciation and amortisation resulting from business combinations | 2023 (2.1) | 2022 (2.2) | Change –1.6% | |||

| in CHF mnOperating income / (loss) (EBIT) | 20237.0 | 20225.2 | Change32.8% | |||

| in CHF mnMargin 4 | 20235.9% | 20224.6% | Change1.3%p | |||

| in CHF mnNormalisation 5 | 20235.7 | 202210.0 | Change–42.9% | |||

| in CHF mnOperating income / (loss) (EBIT adj.) | 202312.7 | 202215.3 | Change–16.9% | |||

| in CHF mnMargin 4 | 202310.7% | 202213.3% | Change–2.6%p | |||

| in CHF mnNumber of employees (FTE) 6 | 2023313 | 2022322 | Change–2.7% | |||

| in CHF mn

|

||||||

| in CHF mn

1 Includes third-party revenue and revenue vis-à-vis other TX segments.

|

||||||

| in CHF mn

2 Includes only companies and activities that were included in the scope of consolidation for the entire reporting period 2023 and 2022. There were no changes in the 20 Minuten segment.

|

||||||

| in CHF mn

3 No IAS 19 pension costs (as in segment reporting).

|

||||||

| in CHF mn

4 The margin relates to revenue.

|

||||||

| in CHF mn

5 Normalisation effects:

– Impairment of the associate Ultimate Media Beteiligungs- und Management GmbH (2023: CHF 3.6 million; 2022: CHF 7.8 million). – Amortisation resulting from business combinations (2023: CHF 2.1 million; 2022: CHF 2.2 million). |

||||||

| in CHF mn

6 Average number of employees, excluding employees in associates / joint ventures.

|

||||||

Launched at the end of 1999 for a young, urban target group, the free newspaper 20 Minuten has developed into the Swiss media brand with the widest coverage and has a presence in eight regions across German-speaking Switzerland, western Switzerland and Ticino. News from Switzerland and around the world, entertainment and inspiration: 20 Minuten tells stories that get people talking. The journalism of 20 Minuten is reliable, compact, responsible, free from ideology and available at no cost to all. 20 Minuten offers a wide range of multimedia content on both digital channels and social media. 20 Minuten also has investments in the free newspaper Heute and heute.at in Austria as well as in L’essentiel in Luxembourg.

2023 was an extremely challenging year for the media industry as a whole, including 20 Minuten. One positive development was the growth in advertising revenue, with overall revenues at the 20 Minuten Group also increasing on the previous year. However, structural change and the migration of digital advertising money towards the major international tech companies remain a challenge. Consequently, savings measures had to be introduced in the reporting year to facilitate adjustment to the new realities. The costs for the social plan have already been recognised, but the measures will not have a positive effect on results until 2024. The results of 20 Minuten also suffered in 2023 on account of a write-down involving the print edition of Heute as well as a decline in revenues at heute.at. By contrast, the results of L’essentiel in Luxembourg showed a very positive trend.

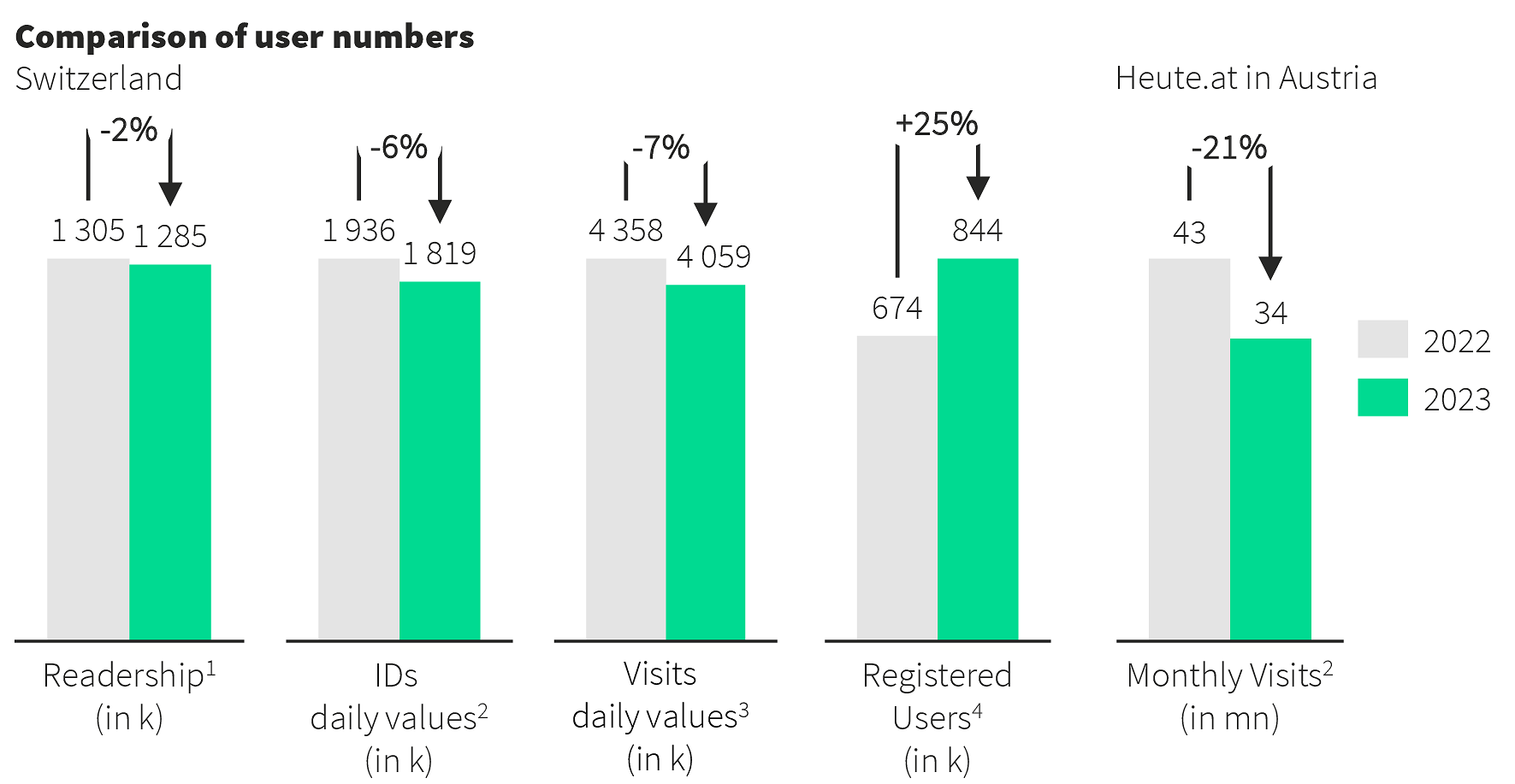

In Switzerland, 20 Minuten restricted its focus to the core business of journalism in the reporting year. For example, the editorial team adopted a cross-functional approach in German-speaking Switzerland, and traditional news vehicles were strengthened too. Following a significant decline in user figures in the first half of 2022, the negative trend was halted in 2023 and user figures stabilised. The number of registered users also increased significantly: logins are important in terms of developing a better understanding of user behaviour and appealing directly to target groups with content and advertising. On social media, 20 Minuten is Switzerland’s leading private media brand in terms of user engagement. Follower numbers remained stable in 2023, based on a total in excess of 3.5 million across all social media channels in German-speaking and western Switzerland. More success is also being achieved in terms of attracting young social media users to the digital platforms of 20 Minuten (web, app).

WhatsApp channel

20 Minuten is already introducing the new WhatsApp channels in Switzerland, becoming the first Swiss news medium to relay its stories via a WhatsApp channel. The offering is making an impact, attracting over 100,000 subscribers in just seven weeks. More themed channels for sport, weather and finance are set to follow. By the end of the year, over 140,000 people were subscribed to one of the channels.

The channel is also of considerable interest within the advertising market, with 20 Minuten set to launch a sponsored content format for WhatsApp in the very near future. The successful concept is also being adopted at L’essentiel in Luxembourg (20,000 subscribers) and Heute in Austria (35,000 subscribers).

20 Minuten is aiming to consolidate its leading position within the user market. There are also plans to further optimise the cross-media offering for the advertising market and show greater innovation in this area. Various strategic initiatives are being promoted with a view to achieving this, such as in the area of digital story telling and digital products, community and AI.

1 Readership: number of readers of print editions in Switzerland (source WEMF MACH Basic 2023-2).

2 Daily figures for IDs: daily average for all cookies / browsers / device IDs on the digital platforms of 20 Minuten (whole of Switzerland, excluding Ticino (TicinOnline)) per day (Source: Mediapulse Online Data (April 2022 to December 2023), internal data (January 2022 to March 2022)) or on the digital platforms of heute.at in Austria per month (source: Österreichische Webanalyse).

3 Daily figures for visits: daily average for visits to the digital platforms of 20 Minuten in Switzerland (excluding Ticino (TicinOnline)) (source: Mediapulse Online Data (April 2022 to December 2023), internal data (January 2022 to March 2022)).

4 Registered users: number of users registered on the platforms of 20 Minuten in Switzerland (own figures).

Tamedia

www.tamedia.ch

Managing Director: Jessica Peppel-Schulz

| in CHF mn | 2023 | 2022 | Change | |||

|---|---|---|---|---|---|---|

| Advertising revenue 1 | 90.2 | 90.3 | –0.0% | |||

| Classifieds & services revenue 1 | 34.6 | 38.1 | –9.2% | |||

| Subscriptions & single sales revenue 1 | 226.8 | 231.0 | –1.8% | |||

| Printing & logistics revenue 1 | 87.3 | 98.8 | –11.6% | |||

| Other operating revenue 1 | 6.4 | 4.7 | 35.4% | |||

| Other income 1 | 1.1 | 1.5 | –29.7% | |||

| Revenues | 446.4 | 464.4 | –3.9% | |||

| of which organic revenues 2 | 443.5 | 464.4 | –4.5% | |||

| Operating expenses 3 | (432.1) | (460.8) | –6.2% | |||

| Share of net result of associates / joint ventures | (1.0) | 1.3 | n.a. | |||

| Operating income / (loss) before depreciation and amortisation (EBITDA) | 13.4 | 4.9 | 173.0% | |||

| Margin 4 | 3.0% | 1.1% | 1.9%p | |||

| Depreciation and amortisation | (0.7) | (0.6) | 5.0% | |||

| Operating income / (loss) before effects of business combinations (EBIT b. PPA) | 12.7 | 4.3 | 198.2% | |||

| Margin 4 | 2.8% | 0.9% | 1.9%p | |||

| Depreciation and amortisation resulting from business combinations | (18.3) | (18.2) | 0.5% | |||

| Operating income / (loss) (EBIT) | (5.6) | (13.9) | –59.9% | |||

| Margin 4 | –1.2% | –3.0% | 1.7%p | |||

| Normalisation 5 | 20.3 | 20.6 | –1.8% | |||

| Operating income / (loss) (EBIT adj.) | 14.7 | 6.7 | 118.4% | |||

| Margin 4 | 3.3% | 1.4% | 1.8%p | |||

| Number of employees (FTE) 6 | 1 277 | 1 283 | –0.5% | |||

|

|

||||||

|

1 Includes third-party revenue and revenue vis-à-vis other TX segments.

|

||||||

|

2 Includes only companies and activities that were included in the scope of consolidation for the entire reporting period 2023 and 2022. There were no changes in the Tamedia segment.

|

||||||

|

3 No IAS 19 pension costs (as in segment reporting).

|

||||||

|

4 The margin relates to revenue.

|

||||||

|

5 Normalisation effects:

– Correction of deferred revenue from initial consolidation of Berner Oberland Medien (2023: CHF 0.8 mn). – Impairment of the associated companies KEYSTONE-SDA-ATS and LZ Linth Zeitung AG in the previous year (2023: CHF 1.2 mn; 2022: CHF 0.8 mn). – Amortisation resulting from business combinations (2023: CHF 18.3 mn; 2022: CHF 18.2 mn). – Reversal through profit or loss of payments received from previous accounting periods that could not be repaid (2022: CHF –1.5 mn). – Repayment or receipt of extraordinary federal support for reduced delivery of newspapers (2022: CHF 3.1 mn). |

||||||

|

6 Average number of employees, excluding employees in associates / joint ventures.

|

||||||

Tamedia is a Swiss media company, which was founded in 1893 with the Tages-Anzeiger. Today, the company comprises the paid-for daily and Sunday newspapers, magazines and publishing services. The best-known publications include Tages-Anzeiger, SonntagsZeitung, Finanz und Wirtschaft, Schweizer Familie, BZ Berner Zeitung, Basler Zeitung, Das Magazin, Der Bund, 24 heures, Le Matin Dimanche, Tribune de Genève and Bilan. Tamedia has owned 100% (previously 50%) of Berner Oberland Medien AG (BOM) since 1 June 2023. Tamedia also operates three newspaper printing plants in Switzerland.

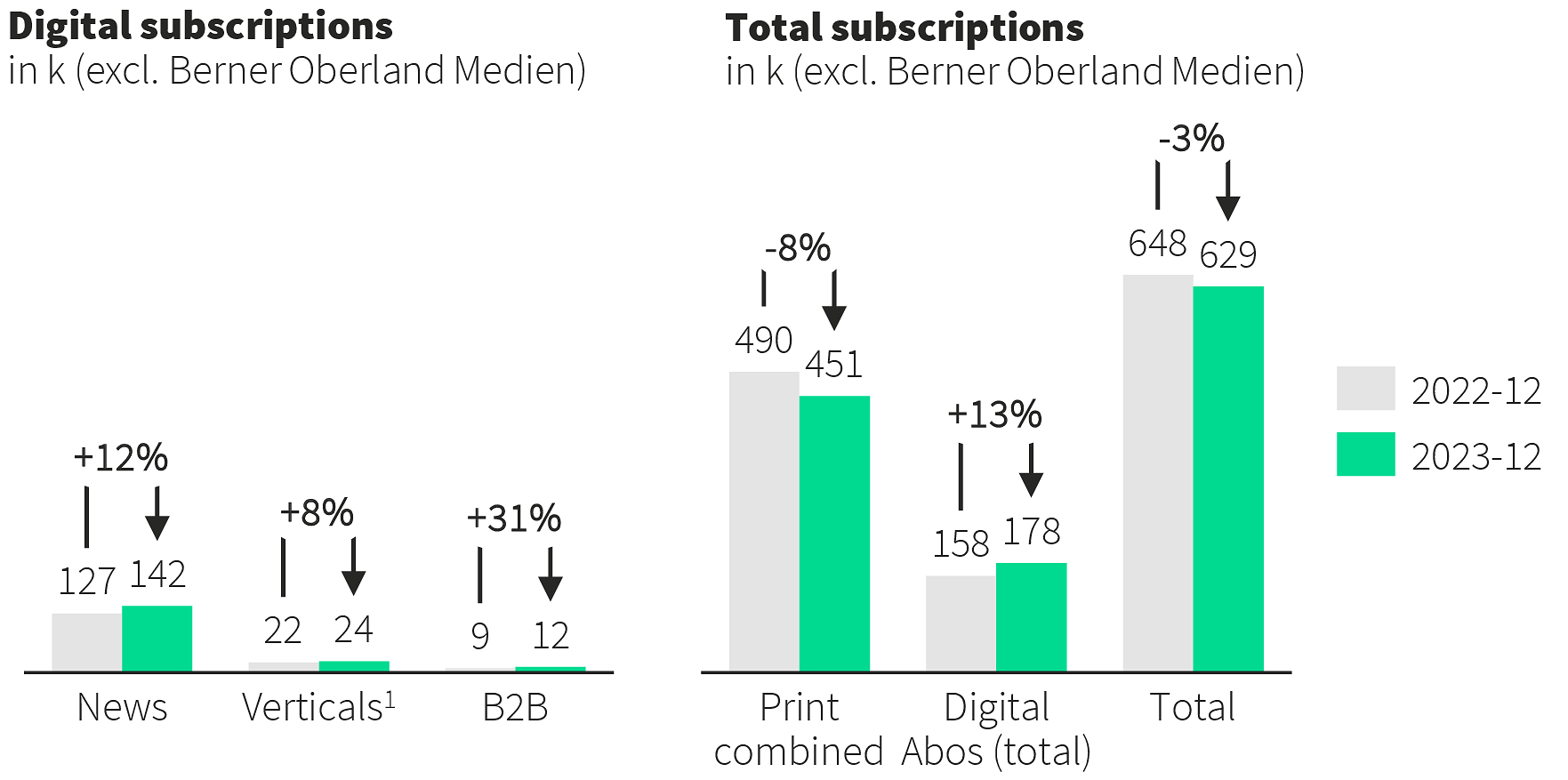

Tamedia is aiming to take a leading role in the digital transformation within the Swiss media landscape. At the end of 2023, the company recorded an increase in digital subscriptions, taking the figure to over 178,000 (excluding BOM). This represents a 13 per cent increase on the previous year. Meanwhile, the decline in print subscriptions continued. Despite this development, Tamedia did not manage to significantly reduce dependency on the print business in the reporting year: the revenues generated from digital subscriptions failed to match expectations.

Advertising revenue was stuck at the previous year’s level. The company also recorded declines in revenue in the print and logistics area as a result of lower paper prices. Thanks to targeted savings and adjustments to the new market situation, Tamedia was able to reduce overall costs and thereby improve its results on the previous year.

1 Verticals are publications whose editorial content may relate to the particular interests of a specific sector, profession or trade, such as “Finanz und Wirtschaft”.

Jessica Peppel-Schulz became CEO of Tamedia in October 2023 and has started a transformation programme with various performance and efficiency initiatives. Performance initiatives refer to measures aimed at driving forward and optimizing the development of existing business areas such as the advertising market and the subscription business.

This includes, for example, improving performance across the main business areas through measures such as targeted boosting of coverage, sales initiatives and doing more to exploit the advertising market. By contrast, efficiency initiatives are concerned with optimising costs in existing business areas. As part of the transformation process at Tamedia, all areas are continuously evaluated and declining areas are checked for their sustainability.

Tamedia sets up AI Lab

In 2023, Tamedia set up the “AI Lab”, which looks at how the company can use artificial intelligence. The AI Lab introduced the teaser generator for short reports and agency reports. The test phase incorporated tools like an SEO helper for teaser optimisation, a clipping tool for print cut-outs, an automatic summary generator for newsletters and briefings and a spellchecker for text quality control. The AI Lab uses partners for the transcription of audio files and the subtitling of videos to help optimise the editorial workflow and relay content in a more targeted way.