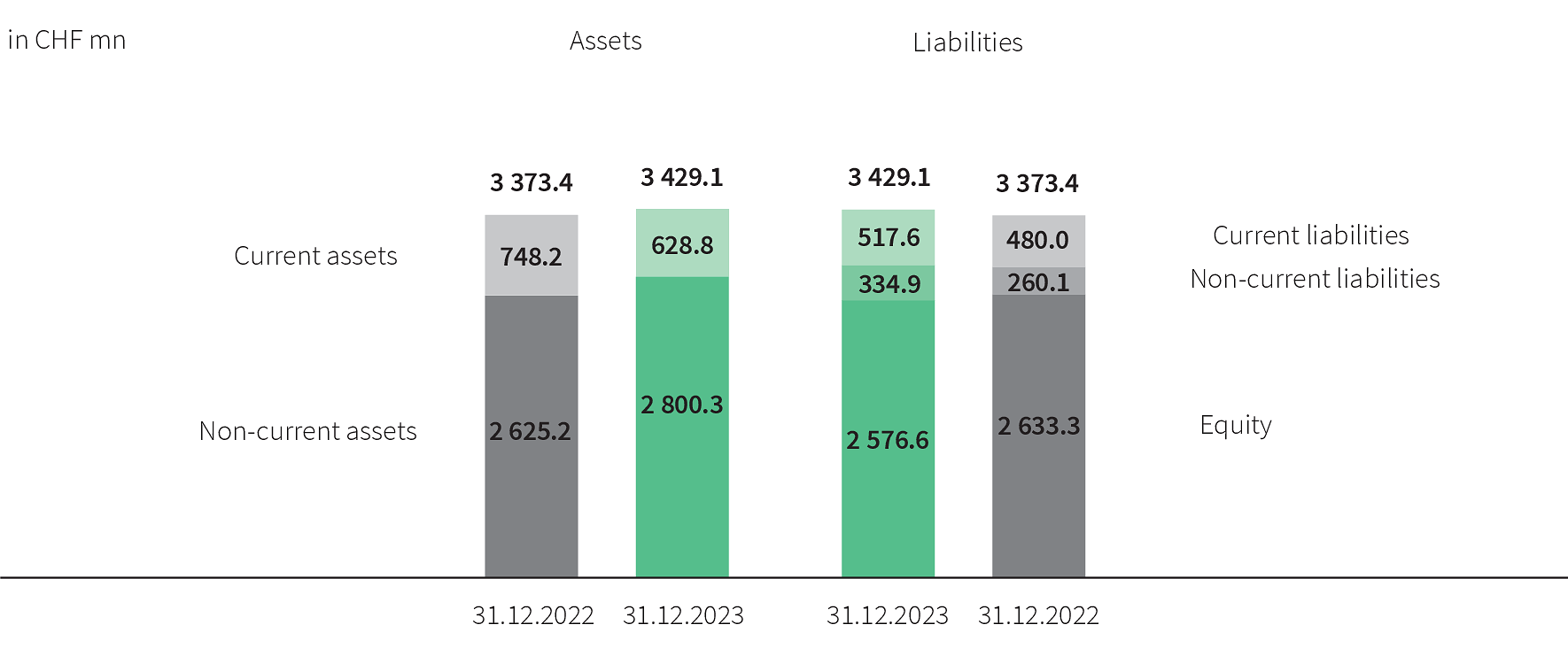

Balance sheet

Total assets increased to CHF 3,429.1 million per end of 2023 (previous year: CHF 3,373.4 million). Cash and cash equivalents amounted to CHF 287.2 million (previous year: CHF 316.3 million). Equity decreased to CHF 2,576.6 million from CHF 2,633.3 million in the previous year. Besides the positive net income (EAT) in the amount of CHF 60.4 million (previous year: CHF –4.0 million), the reduction in equity is attributable to the amount, recognised directly in equity, for the revaluation of employee benefits plan assets / obligations by a net CHF 26.8 million (previous year: CHF –235.0 million, after deferred taxes in each case), the purchase of non-controlling interests worth CHF –24.5 million and the slightly lower dividends paid in the amount of CHF –117.1 million (previous year: CHF –119.1 million). Other significant impacts on the balance sheet include the decline in current financial assets due to repayment of time deposits and bond funds of CHF –71.8 million, the significant increase in property, plant and equipment by CHF 74.4 million due to additional leases in the out-of-home area (acquisition of Clear Channel Schweiz) and the associated increase in liabilities from leases. Intangible assets also increased again on account of goodwill of CHF 45.8 million newly recognised. The rest of the balance sheet remained largely unchanged from the previous year.

| 31.12.2023 | 31.12.2022 | |||||

|---|---|---|---|---|---|---|

| Equity ratio 1 | x | 75.1% | 78.1% | |||

| Quick ratio 2 | x | 120.2% | 154.3% | |||

| Asset coverage ratio II 3 | x | 104.0% | 110.2% | |||

| Net current assets 4 | CHF mn | 111.2 | 268.2 | |||

| Debt factor 5 | x | – | – | |||

|

|

||||||

|

1 Equity to total assets.

|

||||||

|

2 Current assets less inventories to current liabilities.

|

||||||

|

3 Equity and long-term debt to fixed assets.

|

||||||

|

4 Current assets less current liabilities.

|

||||||

|

5 Net debt to cash flow from / (used in) operating activities.

|

||||||