Tamedia

www.tamedia.ch

Managing Director: Andreas Schaffner

| in CHF mn | 2022 | 2021 | Change | |||

|---|---|---|---|---|---|---|

| Advertising revenue 1 | 90.3 | 98.0 | –7.9% | |||

| Classifieds & services revenue 1 | 38.1 | 34.4 | 10.7% | |||

| Subscriptions & single sales revenue 1 | 231.0 | 239.1 | –3.4% | |||

| Printing & logistics revenue 1 | 98.8 | 82.2 | 20.1% | |||

| Other operating revenue 1 | 4.7 | 5.3 | –11.6% | |||

| Other income 1 | 1.5 | 0.1 | 897.5% | |||

| Revenues | 464.4 | 459.3 | 1.1% | |||

| of which organic revenues 2 | 464.4 | 459.3 | 1.1% | |||

| Operating expenses 3 | (460.8) | (440.3) | 4.7% | |||

| Share of net result of associates / joint ventures | 1.3 | 3.4 | –61.9% | |||

| Operating income / (loss) before depreciation and amortisation (EBITDA) | 4.9 | 22.4 | –78.2% | |||

| Margin 4 | 1.1% | 4.9% | –3.8 %p | |||

| Depreciation and amortisation | (0.6) | (0.7) | –15.1% | |||

| Operating income / (loss) before effects of business combinations (EBIT b. PPA) | 4.3 | 21.7 | –80.3% | |||

| Margin 4 | 0.9% | 4.7% | –3.8 %p | |||

| Depreciation and amortisation resulting from business combinations | (18.2) | (21.2) | –14.4% | |||

| Operating income / (loss) (EBIT) | (13.9) | 0.4 | –3400.4% | |||

| Margin 4 | –3.0% | 0.1% | –3.1 %p | |||

| Normalisation 5 | 20.6 | 17.8 | 16.0% | |||

| Operating income / (loss) (EBIT adj.) | 6.7 | 18.2 | –63.0% | |||

| Margin 4 | 1.4% | 4.0% | –2.5 %p | |||

| Number of employees (FTE) 6 | 1 283 | 1 363 | –5.9% | |||

|

|

||||||

|

1 Includes third-party revenue and revenue vis-à-vis other TX segments.

|

||||||

|

2 Includes only companies and activities that were included in the scope of consolidation for the entire reporting period 2022 and 2021. There were no changes in the Tamedia segment.

|

||||||

|

3 No IAS 19 pension costs (as in segment reporting).

|

||||||

|

4 The margin relates to revenue.

|

||||||

|

5 Normalisation effects:

– Reversal through profit or loss of payments received from previous accounting periods that could not be repaid (2022: CHF –1.5 million). – Extraordinary federal contributions to the financing of the national news agency (2021: CHF –0.3 million). – Repayment or receipt of extraordinary federal support for reduced delivery of newspapers (2022: CHF 3.1 million; 2021: CHF –3.1 million). – Impairment of the associated LZ Linth Zeitung AG (2022: CHF 0.8 million). – Amortisation resulting from business combinations (2022: CHF 18.2 million; 2021: CHF 21.2 million). |

||||||

|

6 Average number of employees, excluding employees in associates / joint ventures.

|

||||||

Tamedia comprises the paid-for daily and Sunday newspapers, magazines and all publishing services.

Tamedia is a Swiss media company, which was founded in 1893 with the Tages-Anzeiger. Today, the company comprises the paid-for daily and Sunday newspapers, magazines and publishing services. The best-known publications include 24 heures, Basler Zeitung, Bilan, BZ Berner Zeitung, Das Magazin, Der Bund, Finanz und Wirtschaft, Le Matin Dimanche, Schweizer Familie, SonntagsZeitung, Tages-Anzeiger and Tribune de Genève. Tamedia also operates Switzerland’s largest newspaper printing plants in Zurich, Bern and Bussigny. The company has employees in both German-speaking and French-speaking Switzerland.

Tamedia’s revenues in the reporting year are slightly up on the previous year. This is mainly attributable to higher revenues from print and logistics, which are associated in turn with the higher paper prices. The exceptional price rises can be explained by strikes at Finnish paper factories, the war in Ukraine and strong price changes in the energy sector. Between November 2020 and April 2022 alone, paper prices rose by almost 100 per cent. Higher paper costs also had an impact on operating expenses, which are significantly up on the previous year and had an impact on net income. The weak digital market also has a decisive impact on results.

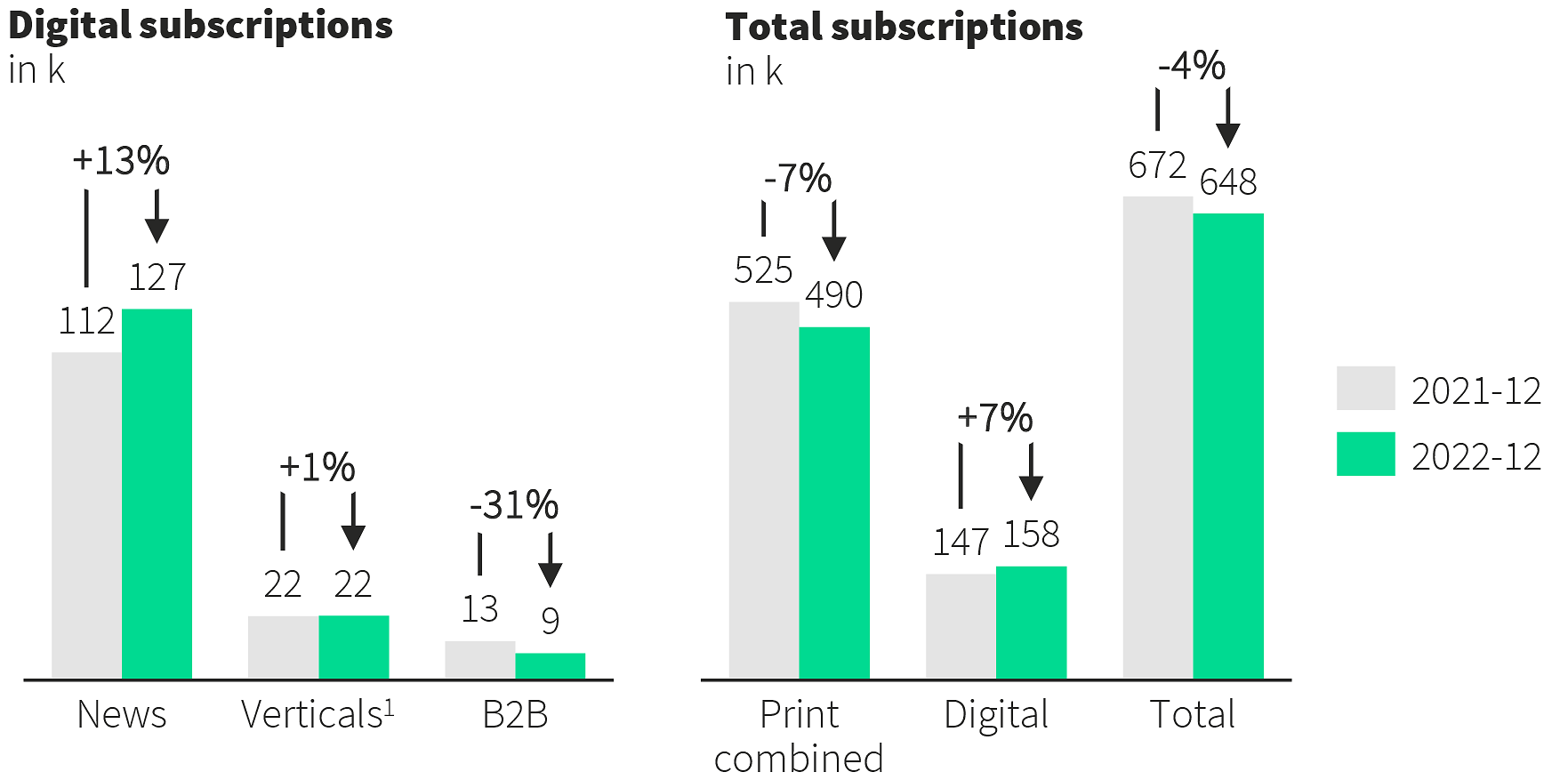

Tamedia’s long-term objective is to offset losses on print subscriptions with sales of digital subscriptions. At the end of December 2022, the company had almost 158,000 digital subscriptions. The increase was considerable, even if the original target (200,000) has yet to be reached. Tamedia’s total circulation declined by more than 3 per cent to 660,000 paid subscriptions over the same period, reflecting the continuing decline in the print sector. For now, however, the print business remains a key pillar within the company. Printed newspapers are still the main source of information for many people in Switzerland.

1 Verticals are publications whose editorial content may relate to the particular interests of a specific sector, profession or trade, such as “Finanz und Wirtschaft”.