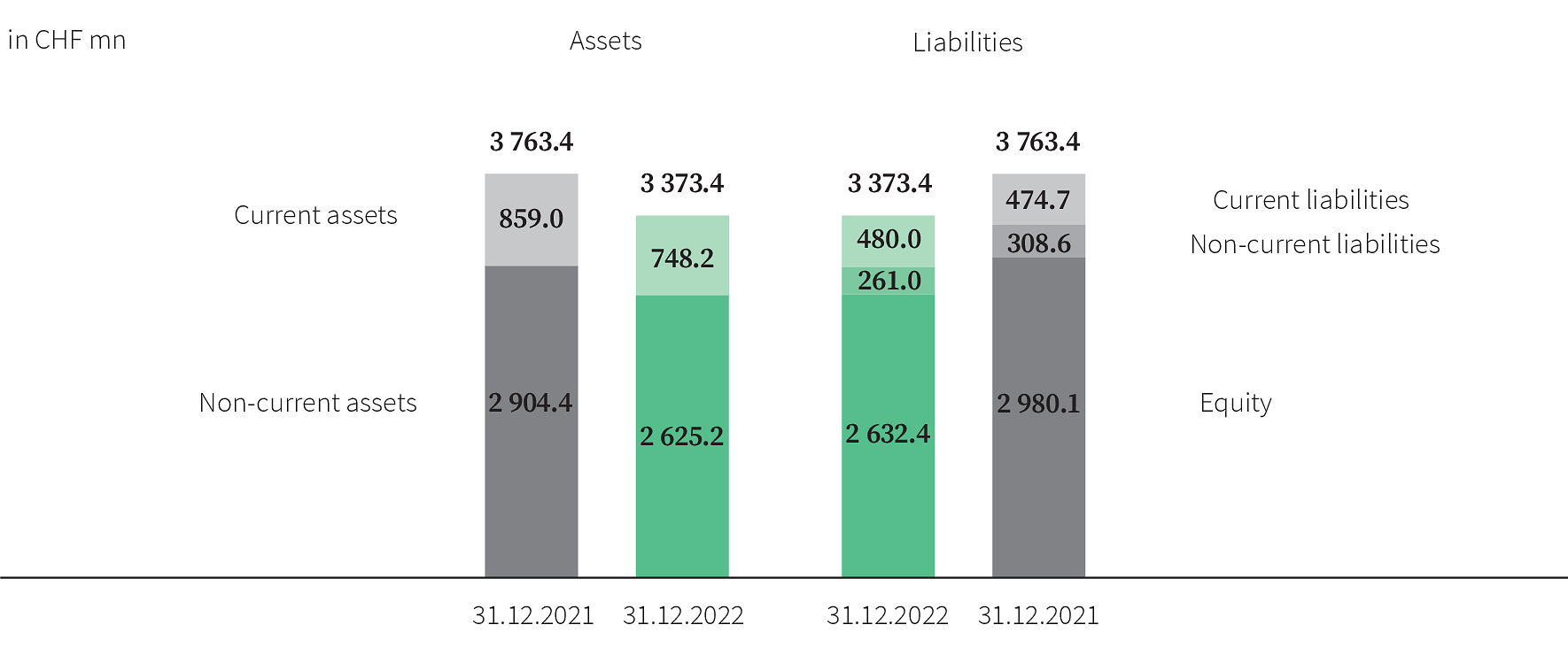

Balance sheet

Total assets decreased to CHF 3,373.4 million as of the end of 2022 (previous year: CHF 3,763.4 million). Cash and cash equivalents amounted to CHF 316.3 million (previous year: CHF 436.5 million). Equity decreased to CHF 2,632.4 million from CHF 2,980.1 million in the previous year. Besides the net loss (EAT) in the amount of CHF –4.6 million (previous year: CHF 832.7 million), the reduction in equity is attributable to the amount, recognised directly in equity, for the revaluation of employee benefits plan assets / obligations by a net CHF –235.0 million (previous year: CHF 193.0 million, after deferred taxes in each case) and to the significantly higher dividends paid in the amount of CHF –119.1 million (previous year: CHF –31.5 million). Other significant impacts on the balance sheet include the special dividend from SMG Swiss Marketplace Group AG in the amount of CHF 89.8 million, which was recognised in the previous year as current financial receivables, the significant increase in property, plant and equipment by CHF 126.9 million due to new leases in the out-of-home business and the reduction in deferred taxes (net) by around CHF 66.7 million. The rest of the balance sheet remained largely unchanged from the previous year.

| 2022 | 2021 | |||||

|---|---|---|---|---|---|---|

| Equity ratio 1 | x | 78.0% | 79.2% | |||

| Quick ratio 2 | x | 154.3% | 180.1% | |||

| Asset coverage ratio II 3 | x | 110.2% | 113.2% | |||

| Net current assets 4 | in CHF mn | 268.2 | 384.3 | |||

| Debt factor 5 | x | – | – | |||

|

|

||||||

|

1 Equity to total assets

|

||||||

|

2 Current assets less inventories to current liabilities

|

||||||

|

3 Equity and long-term debt to fixed assets.

|

||||||

|

4 Current assets less current liabilities.

|

||||||

|

5 Net debt to cash flow from / (used in) operating activities

|

||||||