Statement of cash flows

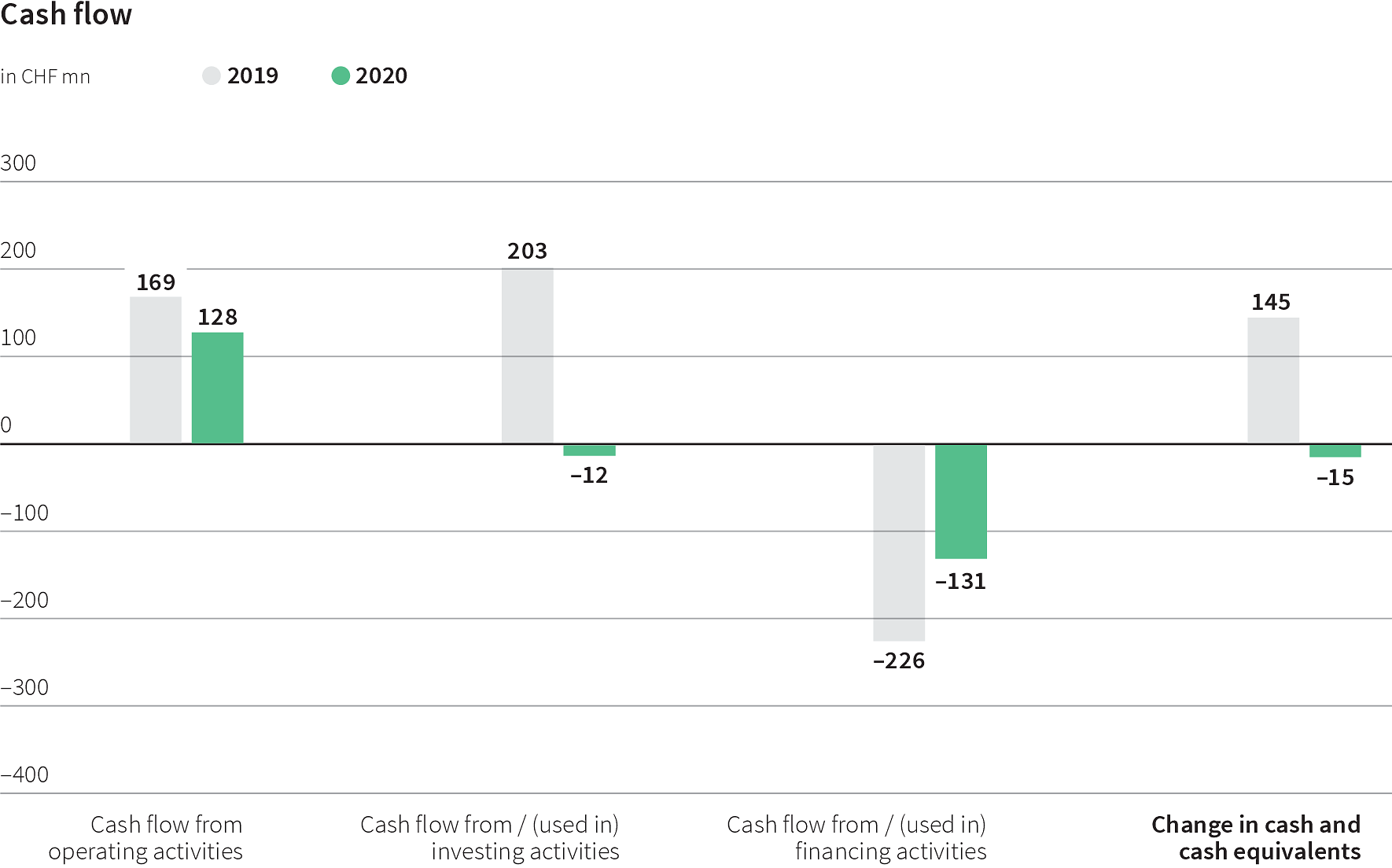

Cash flow from (used in) trading activities decreased by 24.2 per cent to CHF 128.1 million. This decline was due in particular to the reduction in revenues in connection with the coronavirus crisis. The decrease could not be offset by the lower expenditure recorded for personnel and materials and services.

Cash flow from (used in) investing activities amounted to CHF -11.8 million (previous year: CHF 202.6 million). This decrease was mainly due to the cash flow in the amount of CHF 239.8 million that had been recorded in the previous year from the sale of Swisscom Directories AG. Investments in property, plant and equipment and intangible assets increased by CHF 11.4 million compared with the previous year. Investments in property, plant and equipment in the amount of CHF 18.8 million in 2020 included expenditure on tenant improvements and fixtures and fittings at the new head office of JobCloud AG, as well as investments in technical equipment and machinery at the printing centres. The investment of CHF 16.9 million in intangible assets focused primarily on IT software that can be capitalised (such as platforms). The sale of property, plant and equipment and intangible assets resulted in a cash inflow in the amount of CHF 2.0 million. Cash flow after investing activities in property, plant and equipment and intangible assets (FCF adj.) thus amounted to CHF 94.5 million, which is CHF 52.3 million lower than the previous year’s figure of CHF 146.8 million. Cash inflow in the total amount of CHF 19.8 million was realised from the sale of the consolidated companies Olmero AG and Trendsales ApS and the sale of Renovero. Cash outflow from investment in financial assets included the purchase of shares in the other investments neon Switzerland AG, Switzerlend AG and Selma Finance Oy, while the sale of financial assets particularly involved the change to current accounts with non-controlling interests.

Cash flow from (used in) financing activities amounted to CHF -131.4 million. The considerably lower cash outflow here as compared to the previous year was due in particular to the repayment in 2019 of the bank loan in the amount of CHF 120.0 million that was taken out to finance the acquisition of Goldbach, while in 2020, a bank liability in the amount of CHF 20.0 million was repaid. The reduction in cash outflow was also due to the lower dividend payment distributed to TX Group AG shareholders in 2020 as compared to the previous year (CHF 3.50 per share in 2020 as opposed to CHF 4.50 per share in 2019). The dividend payments to the non-controlling interests in JobCloud AG and the Goldbach Group remained stable, however. As a result of new or modified leases, payments for lease liabilities increased by approximately CHF 3.5 million to CHF 15.4 million. The purchase of a non-controlling interest of 10 per cent in Homegate AG in January 2020 resulted in a cash outflow of CHF 20.8 million.

This outflow led to a reduction of cash and cash equivalents of CHF 15.0 million in 2020, from CHF 291.2 million to CHF 276.2 million.