Operating income / (loss) before depreciation and amortisation (EBITDA) and operating income (EBIT)

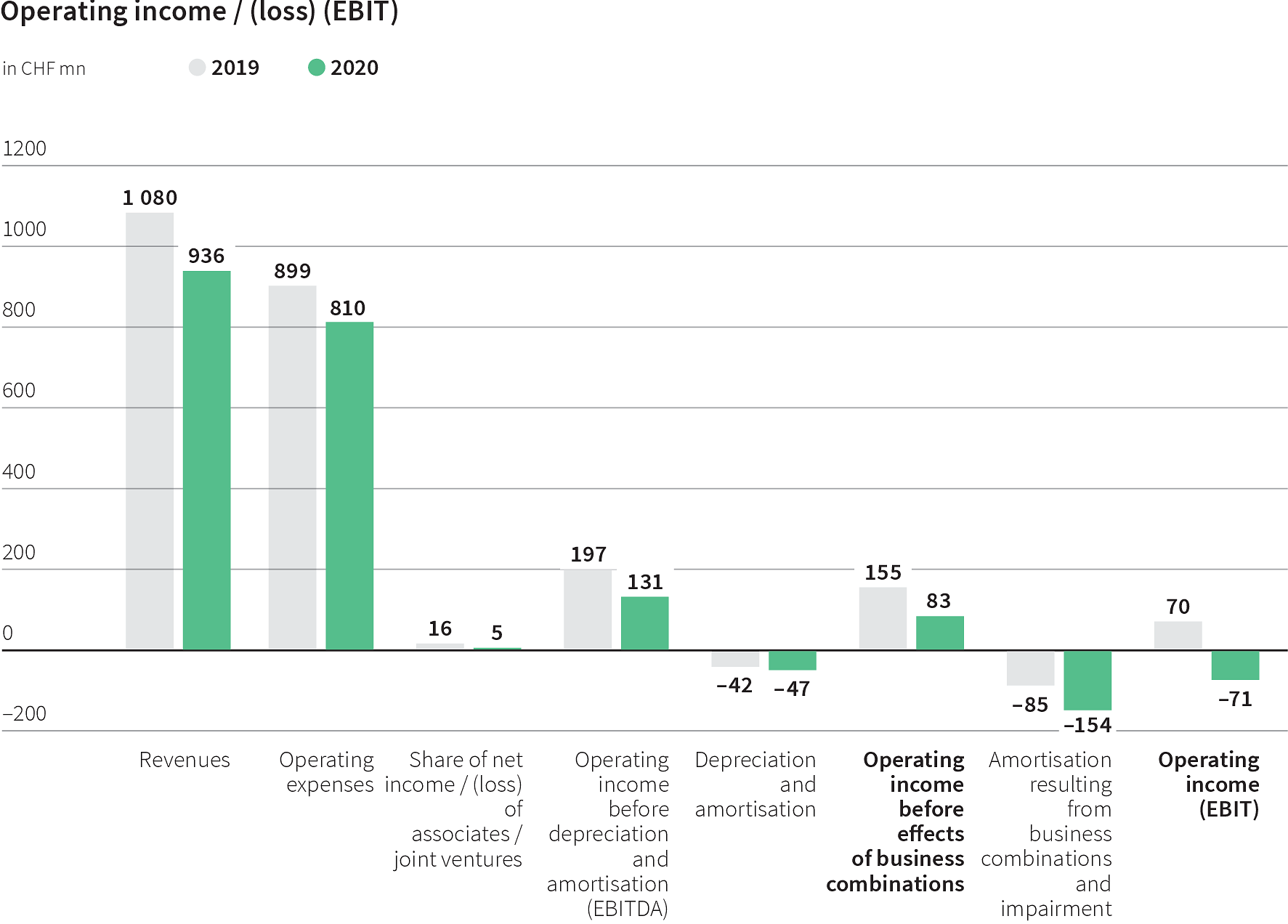

Operating income before depreciation and amortisation (EBITDA) fell by CHF 66.2 million or 33.6 per cent to CHF 130.6 million. The EBITDA margin decreased therefore from 18.2 per cent in the previous year to 14.0 per cent.

The share of net income (loss) of associated companies and joint ventures for the 2020 reporting year amounts to CHF 4.8 million, which is down CHF 11.7 million on the previous year. This decline reflects the very challenging economic environment in 2020, which – not unlike the financial performance of the TX Group – meant the associated companies and joint ventures also experienced a big reduction in operating income. As a result of impairment testing, impairment on goodwill and investments in associated companies was also recorded in the amount of CHF 3.0 million (proportional value).

Operating income (EBIT) amounts to CHF -70.9 million (previous year: 70.4 million), which results in an EBIT margin of -7.6 per cent, as compared to 6.5 per cent in the previous year.

Total depreciation and amortisation increased by CHF 14.9 million from the previous year, to CHF 116.5 million. A total of CHF 9.1 million of the increase in depreciation and amortisation is attributable to increased depreciation and amortisation associated with business combinations. The increase is mainly due to amortisation associated with Tamedia brands. Based on a goodwill impairment test for the cash-generating unit Tamedia, an impairment on goodwill in the amount of CHF 85.0 million was recorded (previous year: CHF 24.7 million).