Balance sheet and equity

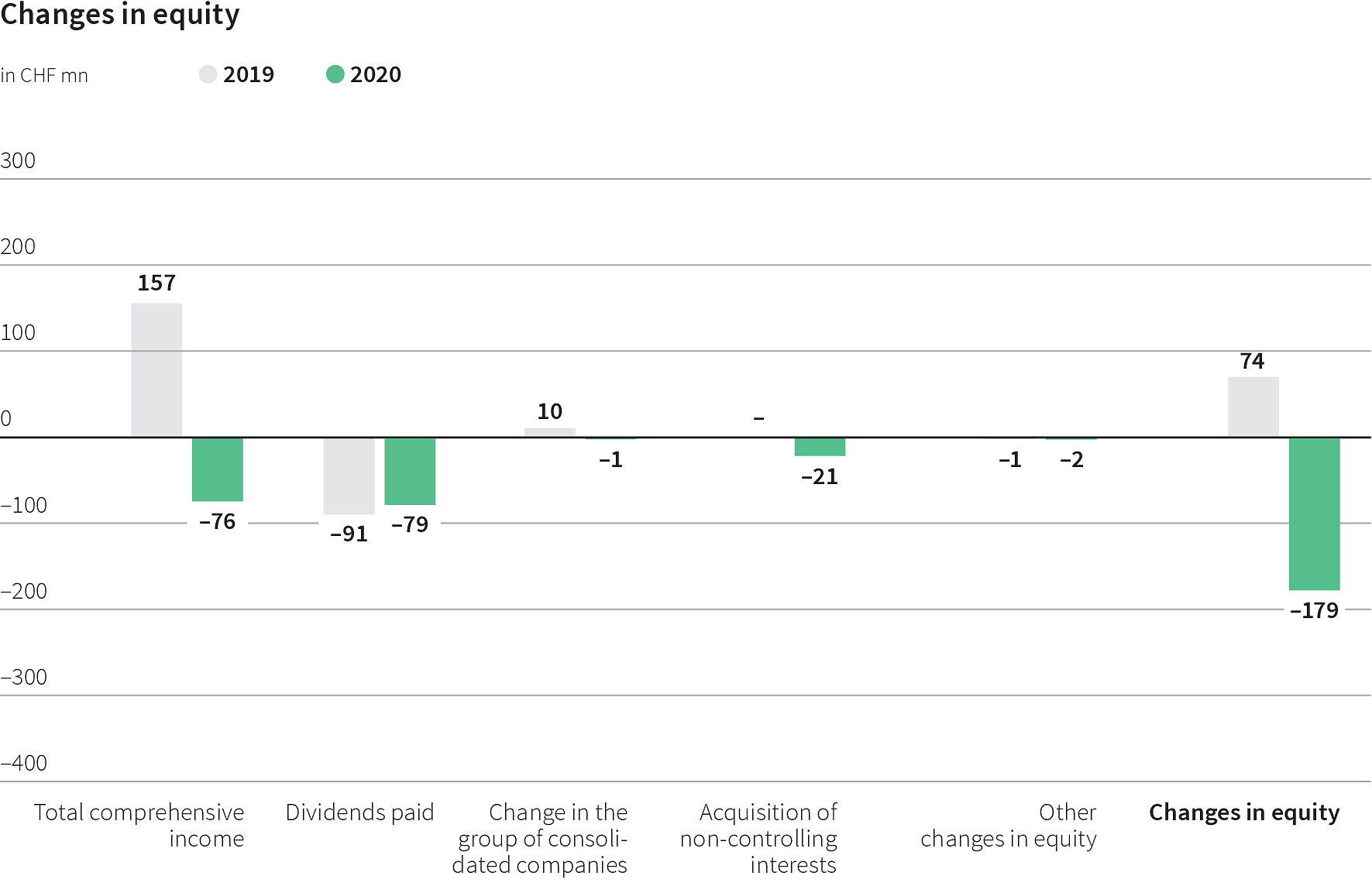

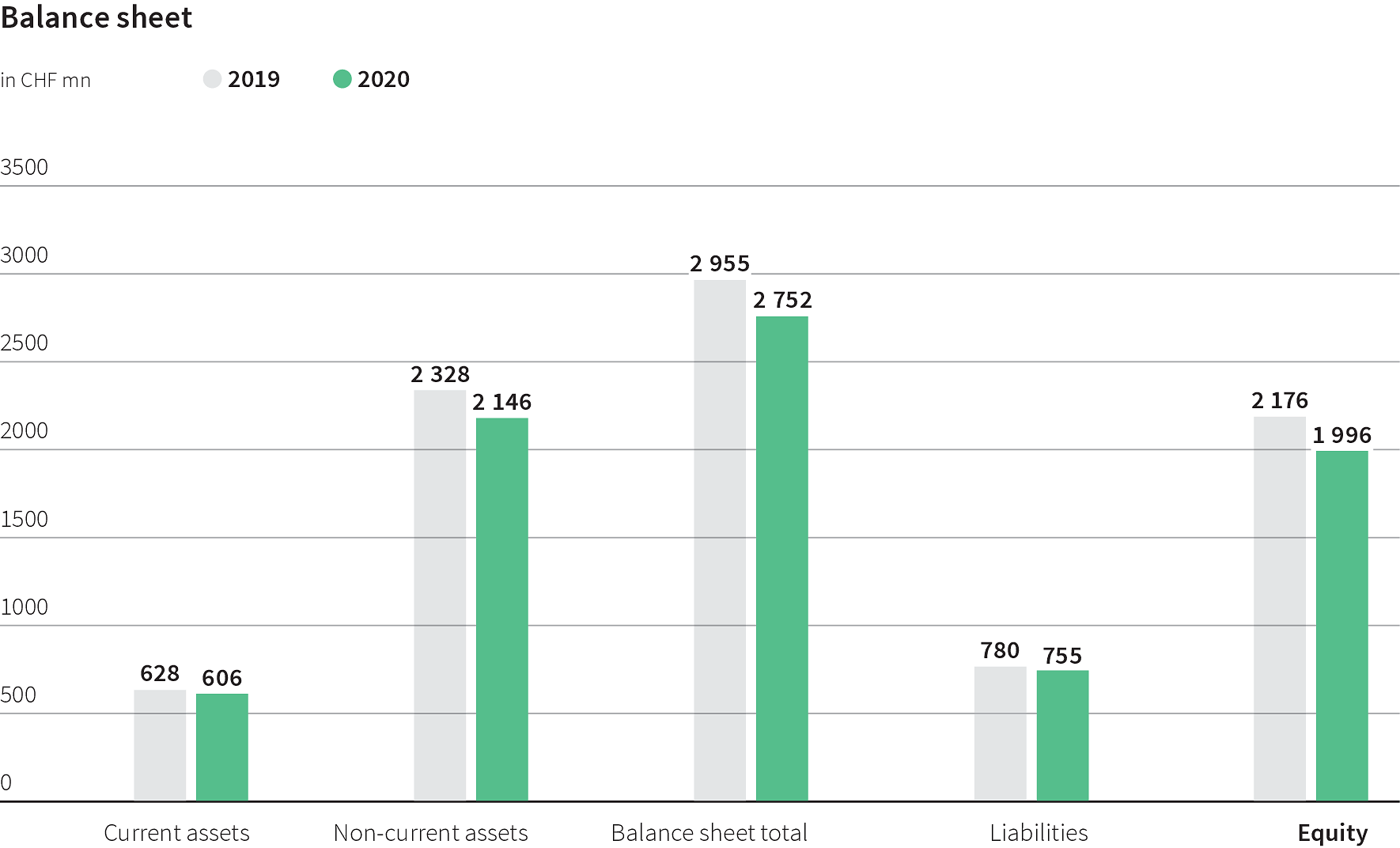

Total assets decreased by CHF 203.8 million, from CHF 2,955.5 million to CHF 2,751.6 million. Equity decreased by CHF 179.3 million to CHF 1,996.4 million. The decrease in equity is attributable to dividend payments, the negative financial result and the purchase of a 10 per cent non-controlling interest in Homegate AG. On the other hand, an equity increase was also recorded through the direct recognition as equity of the revaluation of employee benefits in the net amount of CHF 15.3 million (after deferred taxes), which resulted mainly from the performance of employee benefit plan assets. CHF 37.1 million (CHF 3.50 per share) was distributed to TX Group AG shareholders as a dividend. The company’s equity ratio fell from 73.6 per cent to 72.6 per cent.

The current assets fell by CHF 21.5 million to CHF 606.1 million. Cash and cash equivalents declined by CHF 15.0 million to CHF 276.2 million.

Non-current assets decreased by CHF 182.4 million, or 7.8 per cent, to CHF 2,145.6 million. Property, plant and equipment grew by CHF 16.6 million during the reporting year and amounted to CHF 323.3 million as of the balance sheet date. The increase is primarily attributable to newly recorded right-of-use assets associated with leased properties. Intangible assets decreased by CHF 205.6 million from CHF 1,784.4 million to CHF 1,578.8 million. The change to the group of consolidated companies, which includes the disposals of Olmero AG and Trendsales ApS, led to a decline in intangible assets in the amount of CHF 57.8 million. As in the previous year, investment focused primarily on IT software that can be capitalised. Depreciation and amortisation amounted to CHF 77.3 million (previous year: CHF 67.2 million), whereby this increase is a result of depreciation and amortisation associated with Tamedia brands, which began in 2020. Impairment on goodwill amounting to CHF 85.0 million was recognised in the Tamedia segment in the reporting year (previous year: CHF 24.7 million).

The decline in the shares of net income gained from associates and joint ventures recorded in the income statement is also reflected in their equity and carrying amounts, which decreased by a net of CHF 4.7 million to CHF 61.2 million. The revaluation of employee benefit plans means that net plan assets of CHF 94.9 million are included in the balance sheet for 2020 (previous year: CHF 93.3 million). Employee benefit assets and liabilities totalled CHF 132.6 million and CHF 37.6 million respectively. Other non-current financial assets increased by CHF 9.2 million to CHF 36.0 million, mainly as a result of the investments made in 2020 and fair value adjustments associated with other investments. In 2020, TX Group AG made further investments in the amount of CHF 1.9 million in neon Switzerland AG and acquired 11.7 per cent of the shares in Switzerlend AG for CHF 4.0 million. In December 2020, TX Group AG also took an 11.0 per cent share in Selma Finance Oy, Helsinki (investment of CHF 1.6 million).

Current liabilities decreased by CHF 33.6 million to CHF 480.7 million. Current and non-current financial liabilities increased by CHF 8.9 million to CHF 93.2 million . The bank liability of Goldbach Group AG in the amount of CHF 20.0 million was repaid in January 2020, which means a current credit liability in the amount of CHF 2.0 million (previous year: CHF 1.5 million) remained at the end of 2020.

As of the balance sheet date, there were current lease liabilities in the amount of CHF 13.9 million (previous year: CHF 11.2 million) and non-current lease liabilities in the amount of CHF 54.2 million (previous year: CHF 33.0 million). Much of the increase in lease liabilities is due to the contract for the new premises of JobCloud AG.

Other current liabilities amount to CHF 53.5 million and are therefore up by around CHF 7.5 million on the previous year. This higher amount is primarily due to an increase in liabilities to public authorities in the amount of CHF 3.7 million, and an increase in other current liabilities in the amount of CHF 4.9 million.

Deferred revenues and accrued liabilities decreased by CHF 8.9 million from CHF 337.8 million to CHF 328.9 million. Changes to the group of consolidated companies result in a decrease of around CHF 5.9 million. Total deferred revenue also declined by CHF 5.9 million. The decline in accruals relating to personnel by CHF 8.3 million to CHF 23.3 million is particularly due to the lower accruals for employee performance bonuses and profit participation arrangements for the Group Management.

Current and non-current provisions amounted to CHF 15.6 million, an increase of CHF 0.9 million year-on-year. Personnel-related provisions include provisions for various social plans. The restructuring of central services is intended to reduce costs over a period of three years in order to achieve savings of approximately CHF 20 million. Plans here include reducing the cost of materials and shedding approximately 40 full time positions. Provisions in the amount of CHF 2.3 million were recorded for the Social Plan in connection with the latter measure.

Non-current liabilities increased by CHF 9.0 million to CHF 274.5 million. Employee benefit obligations remained stable at CHF 42.9 million. Deferred tax liabilities dropped by CHF 15.1 million to CHF 145.2 million.